Authors

Summary

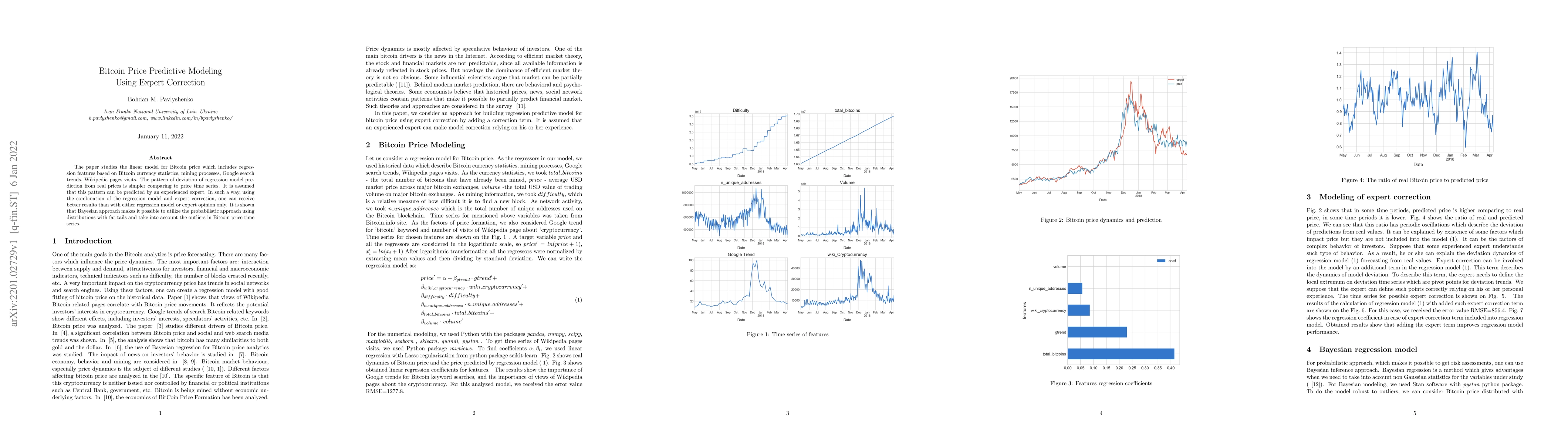

The paper studies the linear model for Bitcoin price which includes regression features based on Bitcoin currency statistics, mining processes, Google search trends, Wikipedia pages visits. The pattern of deviation of regression model prediction from real prices is simpler comparing to price time series. It is assumed that this pattern can be predicted by an experienced expert. In such a way, using the combination of the regression model and expert correction, one can receive better results than with either regression model or expert opinion only. It is shown that Bayesian approach makes it possible to utilize the probabilistic approach using distributions with fat tails and take into account the outliers in Bitcoin price time series.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)