Authors

Summary

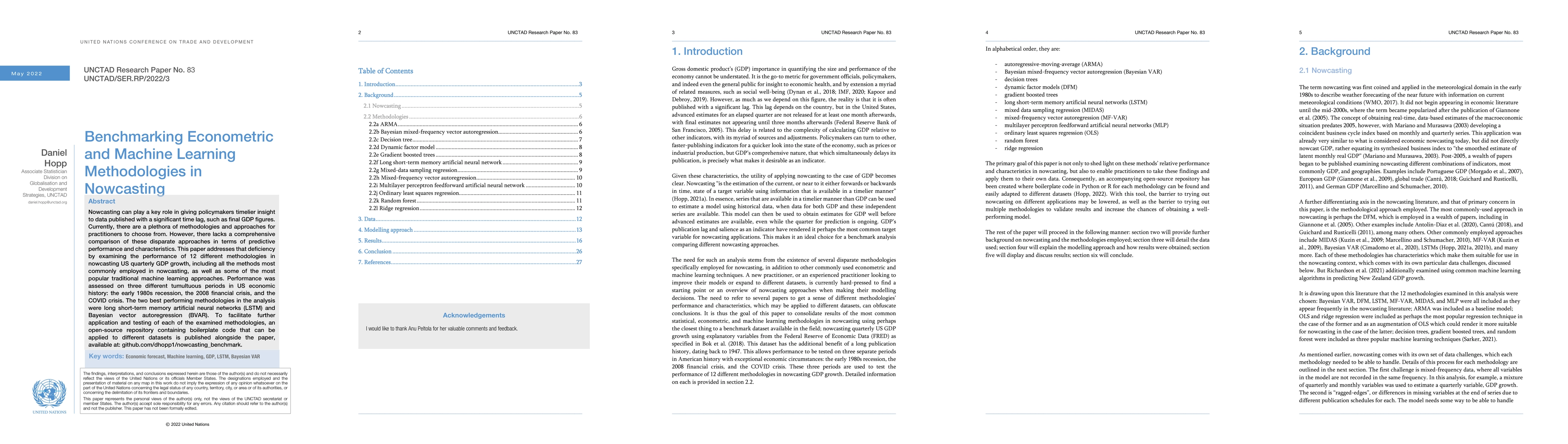

Nowcasting can play a key role in giving policymakers timelier insight to data published with a significant time lag, such as final GDP figures. Currently, there are a plethora of methodologies and approaches for practitioners to choose from. However, there lacks a comprehensive comparison of these disparate approaches in terms of predictive performance and characteristics. This paper addresses that deficiency by examining the performance of 12 different methodologies in nowcasting US quarterly GDP growth, including all the methods most commonly employed in nowcasting, as well as some of the most popular traditional machine learning approaches. Performance was assessed on three different tumultuous periods in US economic history: the early 1980s recession, the 2008 financial crisis, and the COVID crisis. The two best performing methodologies in the analysis were long short-term memory artificial neural networks (LSTM) and Bayesian vector autoregression (BVAR). To facilitate further application and testing of each of the examined methodologies, an open-source repository containing boilerplate code that can be applied to different datasets is published alongside the paper, available at: github.com/dhopp1/nowcasting_benchmark.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHybrid Models for Financial Forecasting: Combining Econometric, Machine Learning, and Deep Learning Models

Robert Ślepaczuk, Dominik Stempień

FloodDamageCast: Building Flood Damage Nowcasting with Machine Learning and Data Augmentation

Ali Mostafavi, Kai Yin, Chia-Fu Liu et al.

Nowcasting Madagascar's real GDP using machine learning algorithms

Franck Ramaharo, Gerzhino Rasolofomanana

No citations found for this paper.

Comments (0)