Summary

Quantum computing is poised to transform the financial industry, yet its advantages over traditional methods have not been evidenced. As this technology rapidly evolves, benchmarking is essential to fairly evaluate and compare different computational strategies. This study presents a challenging yet solvable problem of large-scale dynamic portfolio optimization under realistic market conditions with frictions. We frame this issue as a Quadratic Unconstrained Binary Optimization (QUBO) problem, compatible with digital computing and ready for quantum computing, to establish a reliable benchmark. By applying the latest solvers to real data, we release benchmarks that help verify true advancements in dynamic trading strategies, either quantum or digital computing, ensuring that reported improvements in portfolio optimization are based on robust, transparent, and comparable metrics.

AI Key Findings

Generated Jun 11, 2025

Methodology

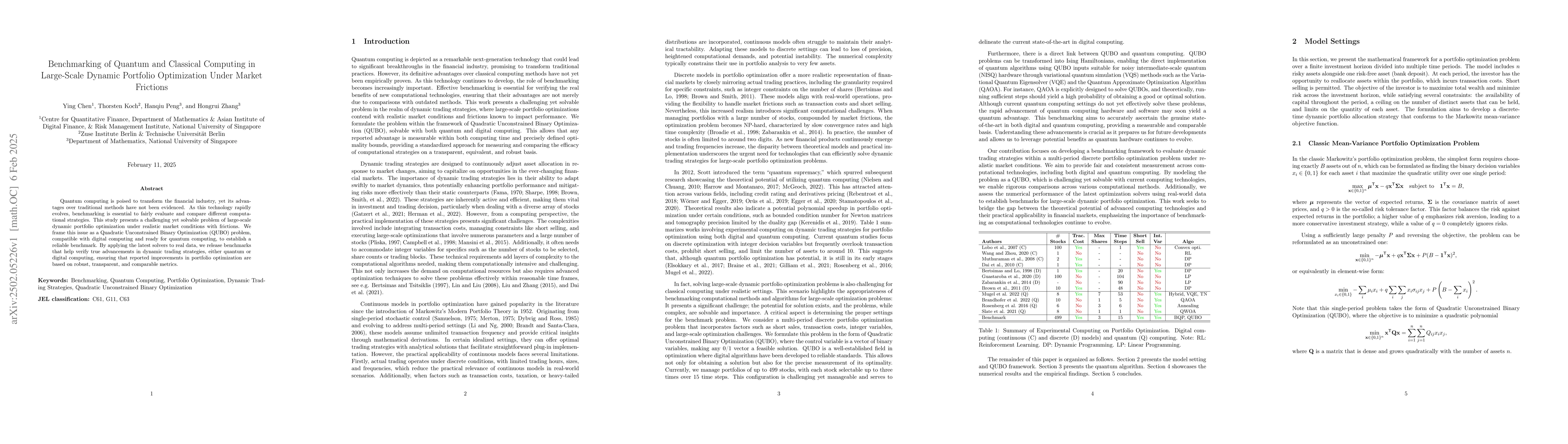

The study establishes a robust benchmark for comparing digital and quantum computing capabilities in handling complex financial optimization problems using a Quadratic Unconstrained Binary Optimization (QUBO) framework for dynamic trading strategies under realistic market conditions with frictions.

Key Results

- Quantum-ready algorithms (QUBO) consistently matched or outperformed the recognized digital solver Gurobi, highlighting their efficacy.

- Both methods plateaued in solution quality after 600 seconds, with marginal gains, indicating current computational limitations.

- The benchmarking exercise demonstrated the QUBO model's effectiveness in portfolio optimization and highlighted the potential benefits of advancements in quantum computing.

- Quantum algorithms like Quantum Approximate Optimization Algorithm (QAOA) show potential for leveraging quantum mechanics to solve large-scale multi-period dynamic optimization problems.

Significance

This research provides a clear insight into the current computational capabilities and limitations of both quantum and digital computing for financial applications, guiding future developments in optimization algorithms.

Technical Contribution

The paper presents a QUBO formulation for large-scale dynamic portfolio optimization under market frictions, providing a standard for solution quality with contemporary computational technologies.

Novelty

The research establishes a transparent and fair platform to evaluate genuine breakthroughs in quantum computing, setting realistic expectations for the performance of emerging computational technologies in handling large-scale financial optimization tasks.

Limitations

- Current quantum computing technology faces challenges, particularly in hardware robustness and noise reduction.

- The study did not achieve significantly better results with current technology, implying that substantial improvements might require advancements in quantum computing hardware.

Future Work

- As quantum computing matures, it has the potential to significantly accelerate and enhance the resolution of complex optimization problems, revolutionizing financial modeling and strategy optimization.

- Further research should focus on addressing current limitations in quantum computing technology to unlock its full potential for practical financial applications.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExploring the synergistic potential of quantum annealing and gate model computing for portfolio optimization

Naman Jain, M Girish Chandra

On Accelerating Large-Scale Robust Portfolio Optimization

Chung-Han Hsieh, Jie-Ling Lu

Decomposition Pipeline for Large-Scale Portfolio Optimization with Applications to Near-Term Quantum Computing

Yue Sun, Ruslan Shaydulin, Marco Pistoia et al.

No citations found for this paper.

Comments (0)