Summary

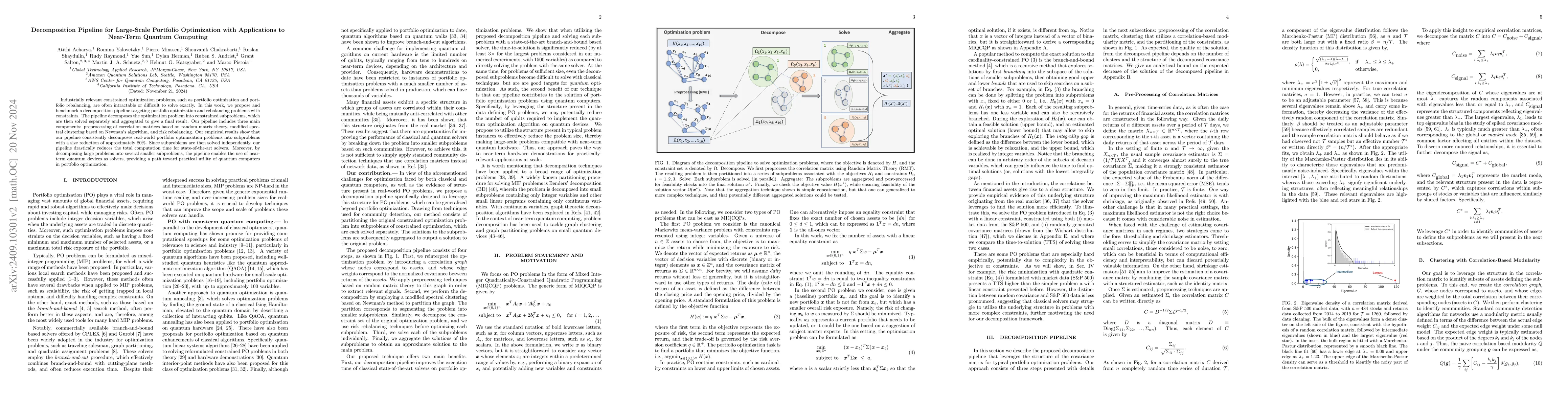

Industrially relevant constrained optimization problems, such as portfolio optimization and portfolio rebalancing, are often intractable or difficult to solve exactly. In this work, we propose and benchmark a decomposition pipeline targeting portfolio optimization and rebalancing problems with constraints. The pipeline decomposes the optimization problem into constrained subproblems, which are then solved separately and aggregated to give a final result. Our pipeline includes three main components: preprocessing of correlation matrices based on random matrix theory, modified spectral clustering based on Newman's algorithm, and risk rebalancing. Our empirical results show that our pipeline consistently decomposes real-world portfolio optimization problems into subproblems with a size reduction of approximately 80%. Since subproblems are then solved independently, our pipeline drastically reduces the total computation time for state-of-the-art solvers. Moreover, by decomposing large problems into several smaller subproblems, the pipeline enables the use of near-term quantum devices as solvers, providing a path toward practical utility of quantum computers in portfolio optimization.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBenchmarking of Quantum and Classical Computing in Large-Scale Dynamic Portfolio Optimization Under Market Frictions

Ying Chen, Thorsten Koch, Hongrui Zhang et al.

Exploring the synergistic potential of quantum annealing and gate model computing for portfolio optimization

Naman Jain, M Girish Chandra

Distributed Quantum Approximate Optimization Algorithm on Integrated High-Performance Computing and Quantum Computing Systems for Large-Scale Optimization

Tengfei Luo, Seongmin Kim, Eungkyu Lee et al.

On Accelerating Large-Scale Robust Portfolio Optimization

Chung-Han Hsieh, Jie-Ling Lu

| Title | Authors | Year | Actions |

|---|

Comments (0)