Summary

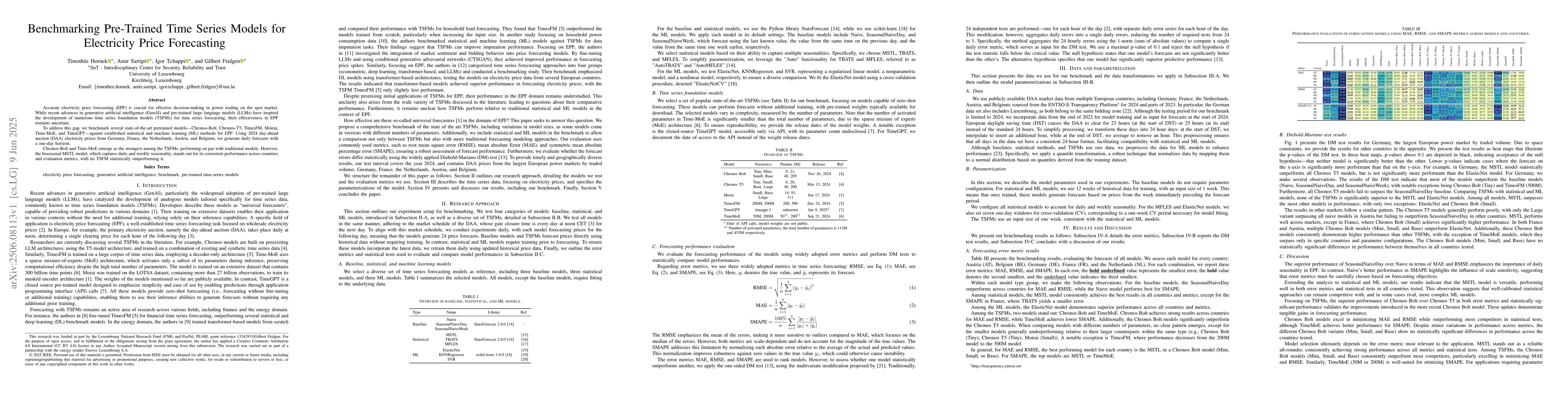

Accurate electricity price forecasting (EPF) is crucial for effective decision-making in power trading on the spot market. While recent advances in generative artificial intelligence (GenAI) and pre-trained large language models (LLMs) have inspired the development of numerous time series foundation models (TSFMs) for time series forecasting, their effectiveness in EPF remains uncertain. To address this gap, we benchmark several state-of-the-art pretrained models--Chronos-Bolt, Chronos-T5, TimesFM, Moirai, Time-MoE, and TimeGPT--against established statistical and machine learning (ML) methods for EPF. Using 2024 day-ahead auction (DAA) electricity prices from Germany, France, the Netherlands, Austria, and Belgium, we generate daily forecasts with a one-day horizon. Chronos-Bolt and Time-MoE emerge as the strongest among the TSFMs, performing on par with traditional models. However, the biseasonal MSTL model, which captures daily and weekly seasonality, stands out for its consistent performance across countries and evaluation metrics, with no TSFM statistically outperforming it.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersBenchmarking Time Series Foundation Models for Short-Term Household Electricity Load Forecasting

Oliver Müller, Marcel Meyer, David Zapata et al.

Benchmarking Quantum Models for Time-series Forecasting

Caitlin Jones, Nico Kraus, Pallavi Bhardwaj et al.

Using Pre-trained LLMs for Multivariate Time Series Forecasting

Michael W. Mahoney, Kari Torkkola, Shenghao Yang et al.

SeqFusion: Sequential Fusion of Pre-Trained Models for Zero-Shot Time-Series Forecasting

Han-Jia Ye, Xu-Yang Chen, Ting-Ji Huang

No citations found for this paper.

Comments (0)