Authors

Summary

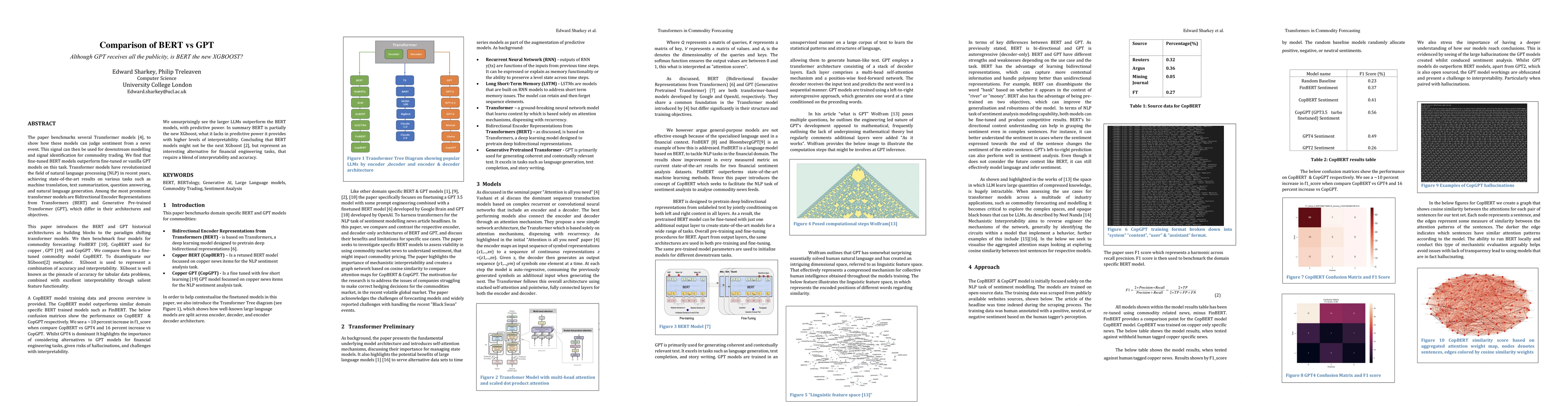

The paper benchmarks several Transformer models [4], to show how these models can judge sentiment from a news event. This signal can then be used for downstream modelling and signal identification for commodity trading. We find that fine-tuned BERT models outperform fine-tuned or vanilla GPT models on this task. Transformer models have revolutionized the field of natural language processing (NLP) in recent years, achieving state-of-the-art results on various tasks such as machine translation, text summarization, question answering, and natural language generation. Among the most prominent transformer models are Bidirectional Encoder Representations from Transformers (BERT) and Generative Pre-trained Transformer (GPT), which differ in their architectures and objectives. A CopBERT model training data and process overview is provided. The CopBERT model outperforms similar domain specific BERT trained models such as FinBERT. The below confusion matrices show the performance on CopBERT & CopGPT respectively. We see a ~10 percent increase in f1_score when compare CopBERT vs GPT4 and 16 percent increase vs CopGPT. Whilst GPT4 is dominant It highlights the importance of considering alternatives to GPT models for financial engineering tasks, given risks of hallucinations, and challenges with interpretability. We unsurprisingly see the larger LLMs outperform the BERT models, with predictive power. In summary BERT is partially the new XGboost, what it lacks in predictive power it provides with higher levels of interpretability. Concluding that BERT models might not be the next XGboost [2], but represent an interesting alternative for financial engineering tasks, that require a blend of interpretability and accuracy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSensitivity Analysis on Transferred Neural Architectures of BERT and GPT-2 for Financial Sentiment Analysis

Andy Xie, Tracy Qian, Camille Bruckmann

| Title | Authors | Year | Actions |

|---|

Comments (0)