Authors

Summary

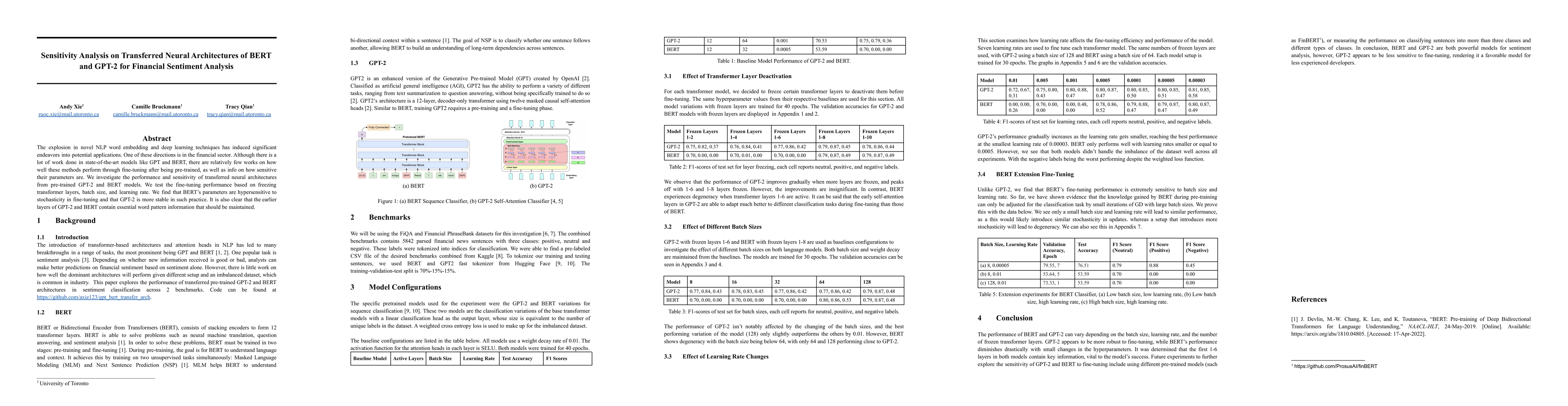

The explosion in novel NLP word embedding and deep learning techniques has induced significant endeavors into potential applications. One of these directions is in the financial sector. Although there is a lot of work done in state-of-the-art models like GPT and BERT, there are relatively few works on how well these methods perform through fine-tuning after being pre-trained, as well as info on how sensitive their parameters are. We investigate the performance and sensitivity of transferred neural architectures from pre-trained GPT-2 and BERT models. We test the fine-tuning performance based on freezing transformer layers, batch size, and learning rate. We find the parameters of BERT are hypersensitive to stochasticity in fine-tuning and that GPT-2 is more stable in such practice. It is also clear that the earlier layers of GPT-2 and BERT contain essential word pattern information that should be maintained.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)