Authors

Summary

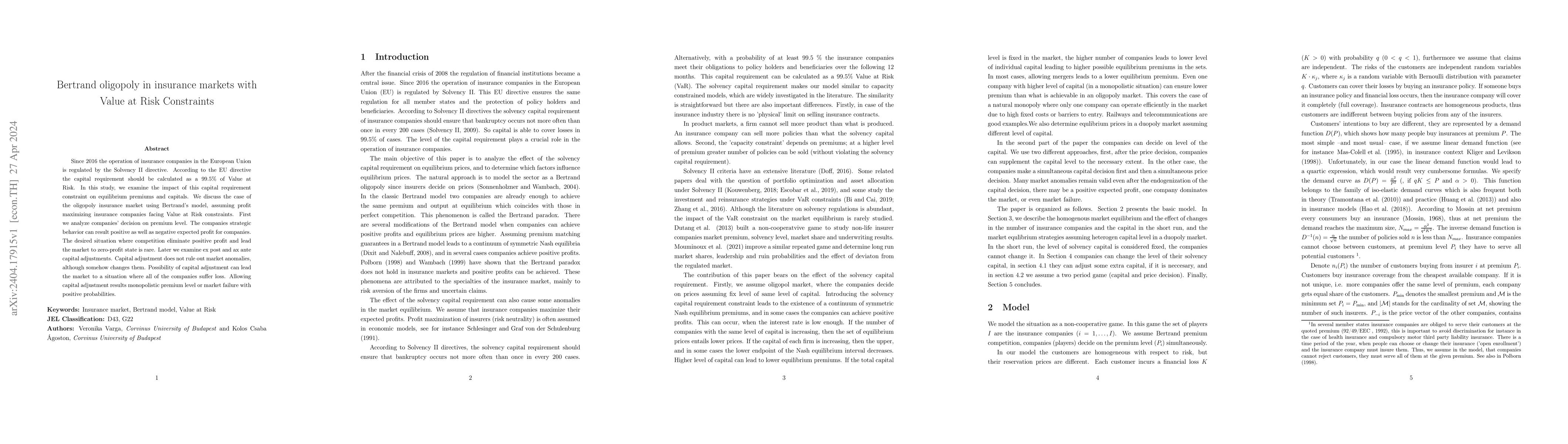

Since 2016 the operation of insurance companies in the European Union is regulated by the Solvency II directive. According to the EU directive the capital requirement should be calculated as a 99.5\% of Value at Risk. In this study, we examine the impact of this capital requirement constraint on equilibrium premiums and capitals. We discuss the case of the oligopoly insurance market using Bertrand's model, assuming profit maximizing insurance companies facing Value at Risk constraints. First we analyze companies' decision on premium level. The companies strategic behavior can result positive as well as negative expected profit for companies. The desired situation where competition eliminate positive profit and lead the market to zero-profit state is rare. Later we examine ex post and ax ante capital adjustments. Capital adjustment does not rule out market anomalies, although somehow changes them. Possibility of capital adjustment can lead the market to a situation where all of the companies suffer loss. Allowing capital adjustment results monopolistic premium level or market failure with positive probabilities.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal insurance design with Lambda-Value-at-Risk

Xia Han, Qiuqi Wang, Yuyu Chen et al.

Value-at-Risk-Based Portfolio Insurance: Performance Evaluation and Benchmarking Against CPPI in a Markov-Modulated Regime-Switching Market

Peyman Alipour, Ali Foroush Bastani

No citations found for this paper.

Comments (0)