Summary

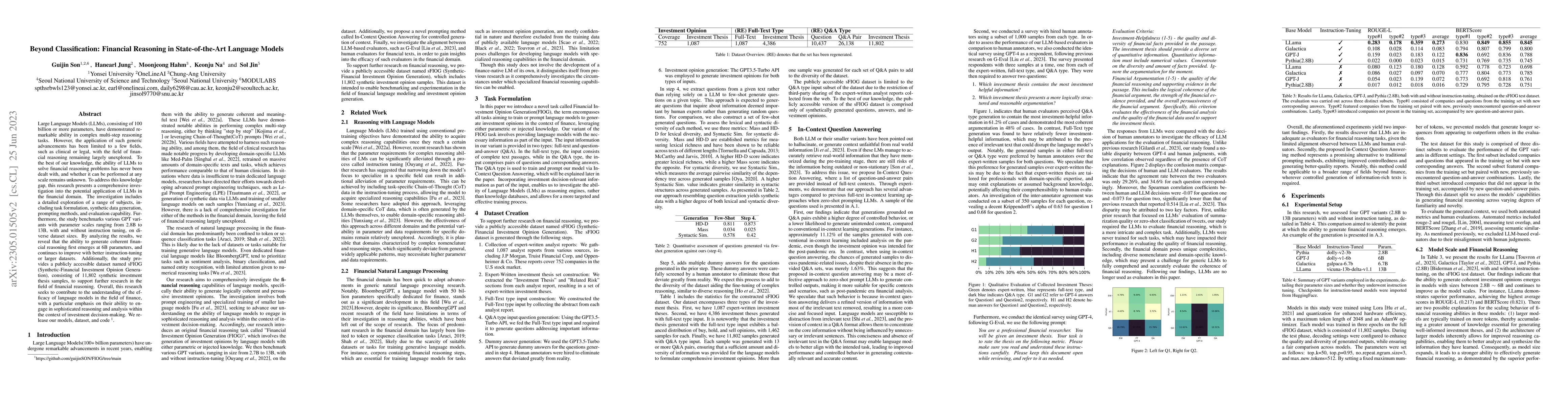

Large Language Models (LLMs), consisting of 100 billion or more parameters, have demonstrated remarkable ability in complex multi-step reasoning tasks. However, the application of such generic advancements has been limited to a few fields, such as clinical or legal, with the field of financial reasoning remaining largely unexplored. To the best of our knowledge, the ability of LLMs to solve financial reasoning problems has never been dealt with, and whether it can be performed at any scale remains unknown. To address this knowledge gap, this research presents a comprehensive investigation into the potential application of LLMs in the financial domain. The investigation includes a detailed exploration of a range of subjects, including task formulation, synthetic data generation, prompting methods, and evaluation capability. Furthermore, the study benchmarks various GPT variants with parameter scales ranging from 2.8B to 13B, with and without instruction tuning, on diverse dataset sizes. By analyzing the results, we reveal that the ability to generate coherent financial reasoning first emerges at 6B parameters, and continues to improve with better instruction-tuning or larger datasets. Additionally, the study provides a publicly accessible dataset named sFIOG (Synthetic-Financial Investment Opinion Generation), consisting of 11,802 synthetic investment thesis samples, to support further research in the field of financial reasoning. Overall, this research seeks to contribute to the understanding of the efficacy of language models in the field of finance, with a particular emphasis on their ability to engage in sophisticated reasoning and analysis within the context of investment decision-making.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersKodeXv0.1: A Family of State-of-the-Art Financial Large Language Models

Neel Rajani, Lilli Kiessling, Aleksandr Ogaltsov et al.

FEVO: Financial Knowledge Expansion and Reasoning Evolution for Large Language Models

Lu Wang, Bo Pang, Ziqi Jia et al.

Reasoning or Overthinking: Evaluating Large Language Models on Financial Sentiment Analysis

Dhagash Mehta, Dimitris Vamvourellis

DianJin-R1: Evaluating and Enhancing Financial Reasoning in Large Language Models

Chi Zhang, Feng Chen, Qian Chen et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)