Authors

Summary

This paper proceeds an approximate calculation of ultimate time survival probability for bi-seasonal discrete time risk model when premium rate equals two. The same model with income rate equal to one was investigated in 2014 by Damarackas and \v{S}iaulys. In general, discrete time and related risk models deal with possibility for a certain version of random walk to hit a certain threshold at least once in time. In this research, the mentioned threshold is the line $u+2t$ and random walk consists from two interchangeably occurring independent but not necessarily identically distributed random variables. Most of proved theoretical statements are illustrated via numerical calculations. Also, there are raised a couple of conjectures on a certain recurrent determinants non-vanishing.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

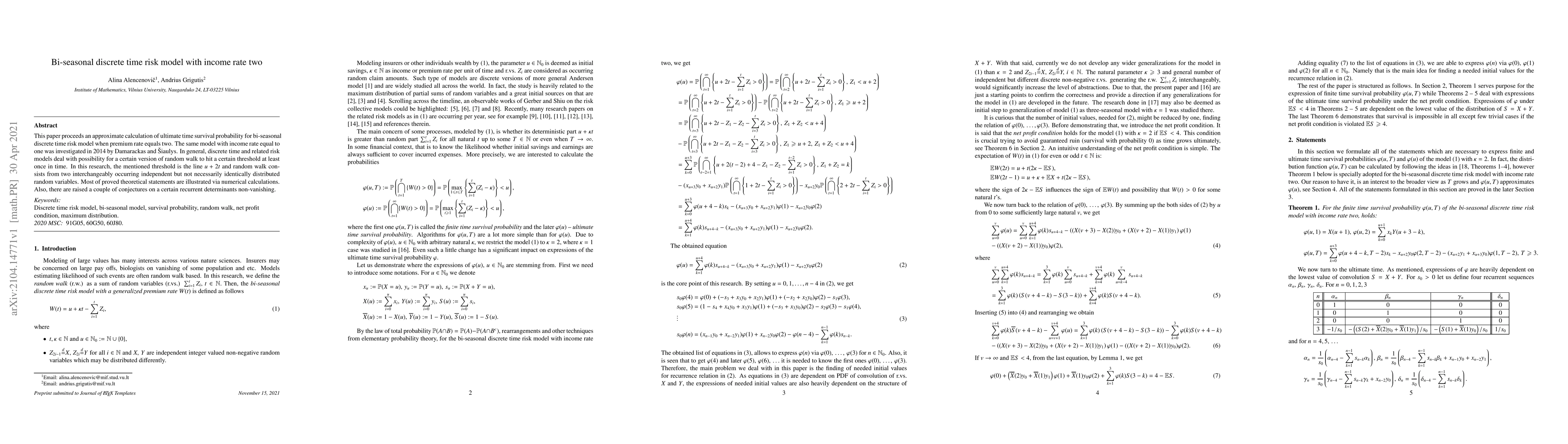

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMulti seasonal discrete time risk model revisited

Andrius Grigutis, Jonas Šiaulys, Jonas Jankauskas

| Title | Authors | Year | Actions |

|---|

Comments (0)