Summary

Is an option to early terminate a swap at its market value worth zero? At first sight it is, but in presence of counterparty risk it depends on the criteria used to determine such market value. In case of a single uncollateralised swap transaction under ISDA between two defaultable counterparties, the additional unilateral option to early terminate the swap at predefined dates requires a Bermudan credit valuation adjustment. We give a general pricing formula assuming a default-free close-out amount, and apply it in a simplified setting with deterministic intensity and one single date of optional early termination, showing that the impact on the fair value of the transaction at inception might be non negligible.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

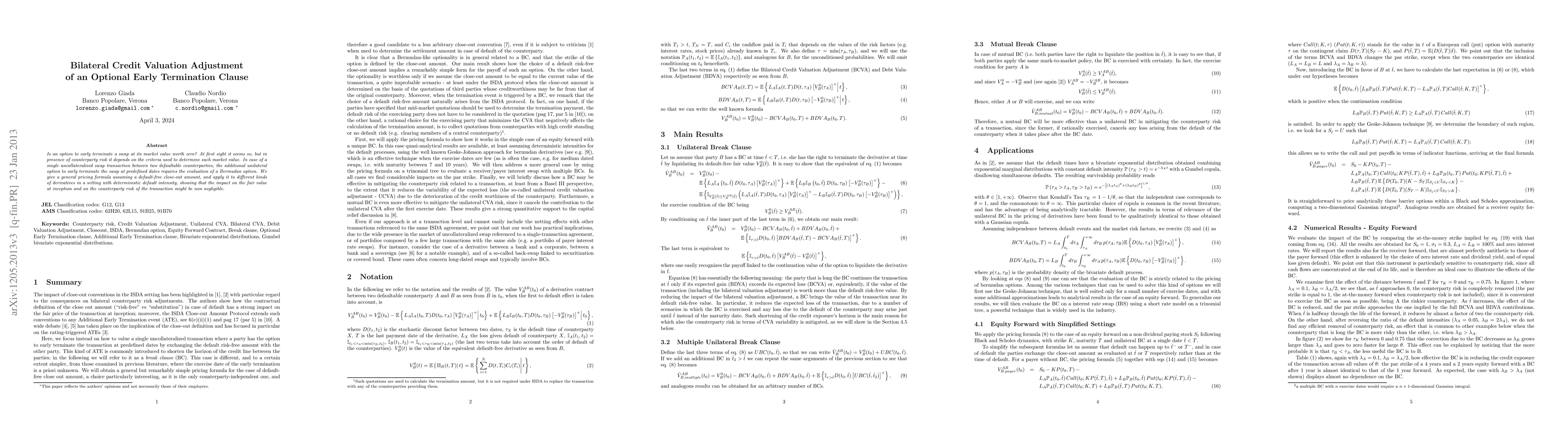

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEfficient Risk Estimation for the Credit Valuation Adjustment

Michael B. Giles, Abdul-Lateef Haji-Ali, Jonathan Spence

| Title | Authors | Year | Actions |

|---|

Comments (0)