Summary

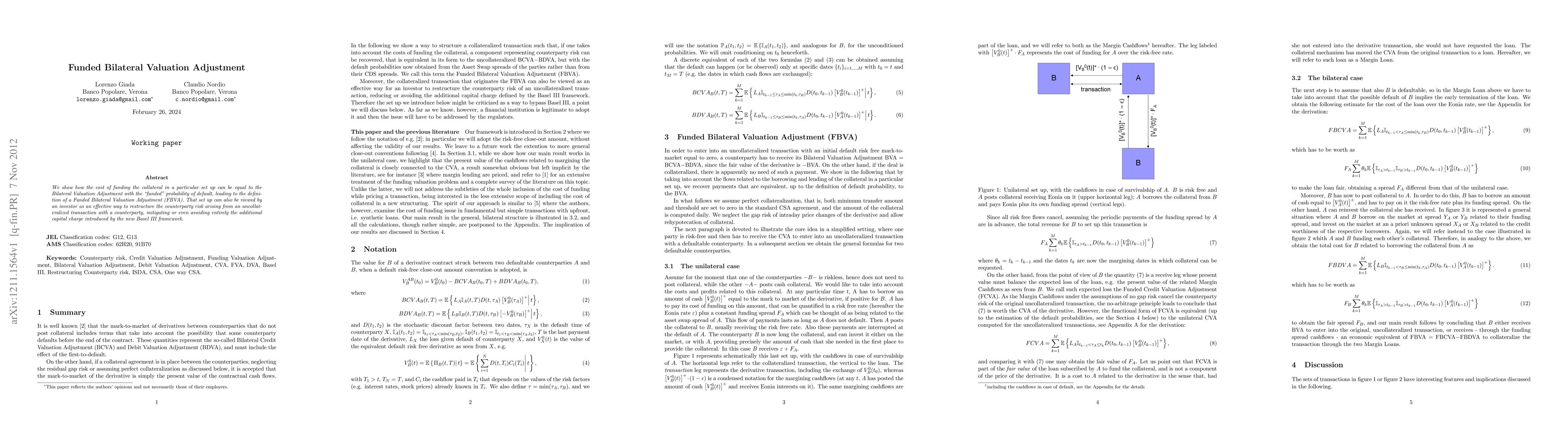

We show how the cost of funding the collateral in a particular set up can be equal to the Bilateral Valuation Adjustment with the "funded" probability of default, leading to the definition of a Funded Bilateral Valuation Adjustment (FBVA). That set up can also be viewed by an investor as an effective way to restructure the counterparty risk arising from an uncollateralized transaction with a counterparty, mitigating or even avoiding entirely the additional capital charge introduced by the new Basel III framework.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)