Summary

We discuss the binary nature of funding impact in derivative valuation. Under some conditions, funding is either a cost or a benefit, i.e., one of the lending/borrowing rates does not play a role in pricing derivatives. When derivatives are priced, considering different lending/borrowing rates leads to semi-linear BSDEs and PDEs, and thus it is necessary to solve the equations numerically. However, once it can be guaranteed that only one of the rates affects pricing, linear equations can be recovered and analytical formulae can be derived. Moreover, as a byproduct, our results explain how debt value adjustment (DVA) and funding benefits are dissimilar. It is often believed that considering both DVA and funding benefits results in a double-counting issue but it will be shown that the two components are affected by different mathematical structures of derivative transactions. We find that funding benefit is related to the decreasing property of the payoff function, but this relationship decreases as the funding choices of underlying assets are transferred to repo markets.

AI Key Findings

Generated Sep 03, 2025

Methodology

The paper employs stochastic calculus and backward stochastic differential equations (BSDEs) to analyze the binary nature of funding valuation adjustments (FVA) in derivative pricing, demonstrating conditions under which FVA can be linearized.

Key Results

- Under certain conditions, funding impact in derivative valuation is binary, either a cost or a benefit, allowing for linear BSDEs and analytical solutions.

- The paper explains the distinction between funding benefits and debt value adjustment (DVA), showing they are affected by different mathematical structures of derivative transactions.

- It is shown that funding benefit relates to the decreasing property of the payoff function, but this relationship diminishes as funding choices shift to repo markets.

Significance

This research provides a clearer understanding of FVA, enabling more accurate derivative pricing and risk management, which is crucial for financial institutions dealing with complex derivatives.

Technical Contribution

The paper introduces a reduction argument for semi-linear BSDEs to linear BSDEs under specific conditions, facilitating analytical solutions for derivative valuation with funding costs.

Novelty

The distinction made between funding benefits and DVA, along with the explanation of how their mathematical structures differ, offers a novel perspective on FVA, clarifying previous misconceptions about double-counting.

Limitations

- The study assumes deterministic default intensities, volatility, and funding spreads, which may limit its applicability to more complex, stochastic market conditions.

- The focus on European-style derivatives and cash flows at multiple times may not generalize well to other types of derivatives or cash flow patterns.

Future Work

- Investigate the implications of stochastic default intensities, volatility, and funding spreads on the binary nature of FVA.

- Explore the extension of findings to a broader range of derivative types and cash flow structures.

Paper Details

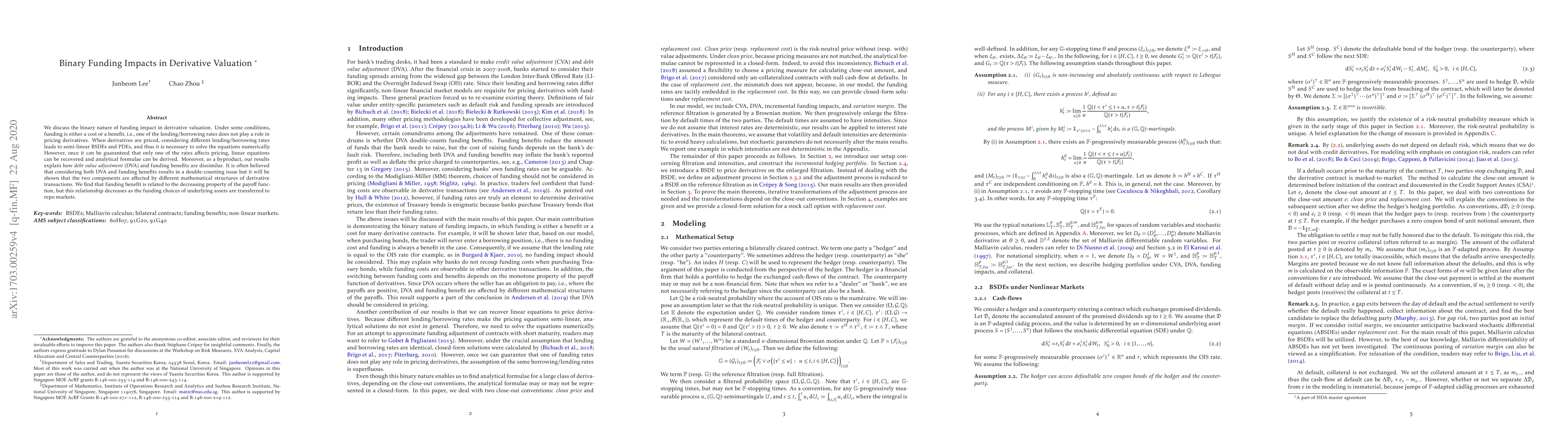

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAnalytical valuation of vulnerable derivative claims with bilateral cash flows under credit, funding and wrong-way risk

Juan Jose Francisco Miguelez, Cristin Buescu

Relevance of Wrong-Way Risk in Funding Valuation Adjustments

T. van der Zwaard, L. A. Grzelak, C. W. Oosterlee

| Title | Authors | Year | Actions |

|---|

Comments (0)