Summary

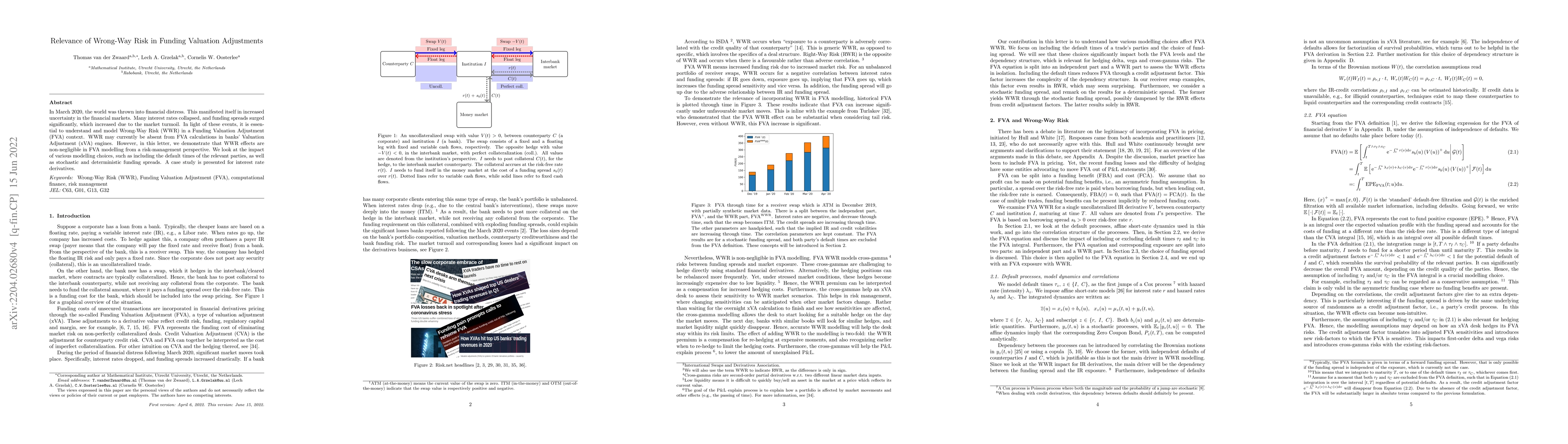

In March 2020, the world was thrown into financial distress. This manifested itself in increased uncertainty in the financial markets. Many interest rates collapsed, and funding spreads surged significantly, which increased due to the market turmoil. In light of these events, it is essential to understand and model Wrong-Way Risk (WWR) in a Funding Valuation Adjustment (FVA) context. WWR may currently be absent from FVA calculations in banks' Valuation Adjustment (xVA) engines. However, in this letter, we demonstrate that WWR effects are non-negligible in FVA modelling from a risk-management perspective. We look at the impact of various modelling choices, such as including the default times of the relevant parties, as well as stochastic and deterministic funding spreads. A case study is presented for interest rate derivatives.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEfficient Wrong-Way Risk Modelling for Funding Valuation Adjustments

T. van der Zwaard, L. A. Grzelak, C. W. Oosterlee

| Title | Authors | Year | Actions |

|---|

Comments (0)