Summary

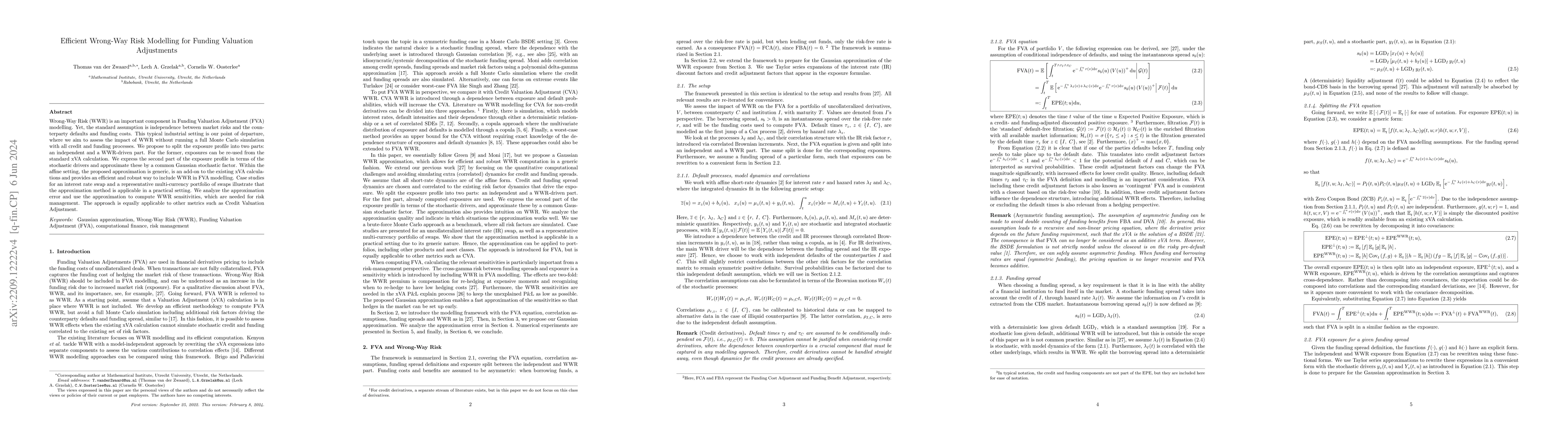

Wrong-Way Risk (WWR) is an important component in Funding Valuation Adjustment (FVA) modelling. Yet, the standard assumption is independence between market risks and the counterparty defaults and funding costs. This typical industrial setting is our point of departure, where we aim to assess the impact of WWR without running a full Monte Carlo simulation with all credit and funding processes. We propose to split the exposure profile into two parts: an independent and a WWR-driven part. For the former, exposures can be re-used from the standard xVA calculation. We express the second part of the exposure profile in terms of the stochastic drivers and approximate these by a common Gaussian stochastic factor. Within the affine setting, the proposed approximation is generic, is an add-on to the existing xVA calculations and provides an efficient and robust way to include WWR in FVA modelling. Case studies for an interest rate swap and a representative multi-currency portfolio of swaps illustrate that the approximation method is applicable in a practical setting. We analyze the approximation error and use the approximation to compute WWR sensitivities, which are needed for risk management. The approach is equally applicable to other metrics such as Credit Valuation Adjustment.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRelevance of Wrong-Way Risk in Funding Valuation Adjustments

T. van der Zwaard, L. A. Grzelak, C. W. Oosterlee

No citations found for this paper.

Comments (0)