Summary

The goal of this work is to study binary market models with transaction costs, and to characterize their arbitrage opportunities. It has been already shown that the absence of arbitrage is related to the existence of \lambda-consistent price systems (\lambda-CPS), and, for this reason, we aim to provide conditions under which such systems exist. More precisely, we give a characterization for the smallest transaction cost \lambda_c (called "critical" \lambda) starting from which one can construct a \lambda-consistent price system. We also provide an expression for the set M(\lambda) of all probability measures inducing \lambda-CPS. We show in particular that in the transition phase "\lambda=\lambda_c" these sets are empty if and only if the frictionless market admits arbitrage opportunities. As an application, we obtain an explicit formula for \lambda_c depending only on the parameters of the model for homogeneous and also for some semi-homogeneous binary markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

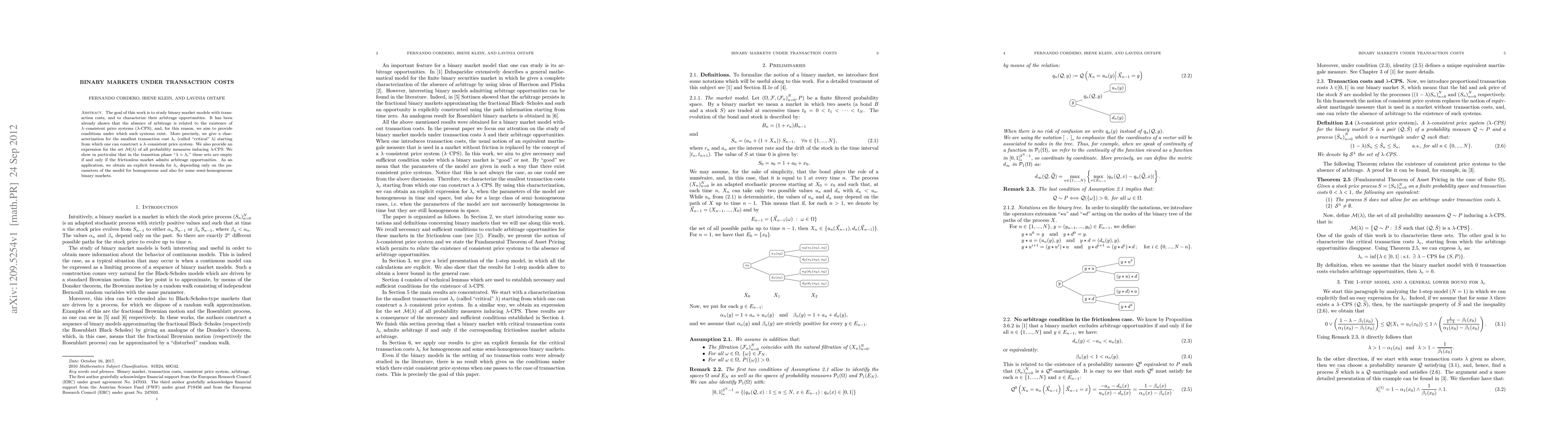

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)