Summary

In this paper, we investigate binary response models for heterogeneous panel data with interactive fixed effects by allowing both the cross-sectional dimension and the temporal dimension to diverge. From a practical point of view, the proposed framework can be applied to predict the probability of corporate failure, conduct credit rating analysis, etc. Theoretically and methodologically, we establish a link between a maximum likelihood estimation and a least squares approach, provide a simple information criterion to detect the number of factors, and achieve the asymptotic distributions accordingly. In addition, we conduct intensive simulations to examine the theoretical findings. In the empirical study, we focus on the sign prediction of stock returns, and then use the results of sign forecast to conduct portfolio analysis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

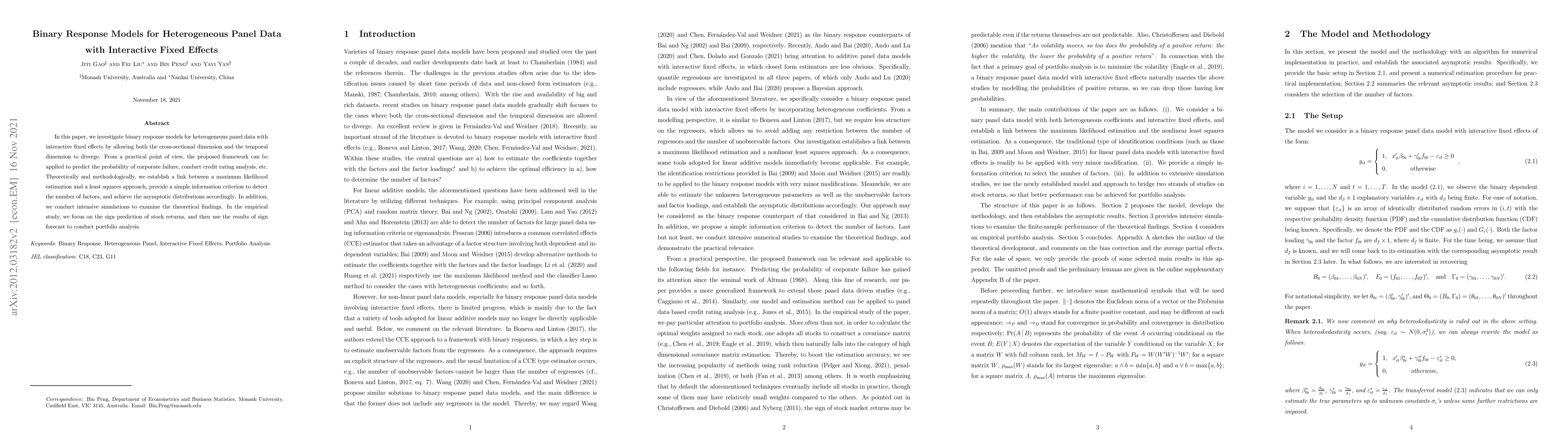

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)