Summary

Interactive fixed effects are a popular means to model unobserved heterogeneity in panel data. Models with interactive fixed effects are well studied in the low-dimensional case where the number of parameters to be estimated is small. However, they are largely unexplored in the high-dimensional case where the number of parameters is large, potentially much larger than the sample size itself. In this paper, we develop new econometric methods for the estimation of high-dimensional panel data models with interactive fixed effects. Our estimator is based on similar ideas as the very popular common correlated effects (CCE) estimator which is frequently used in the low-dimensional case. We thus call our estimator a high-dimensional CCE estimator. We derive theory for the estimator both in the large-T-case, where the time series length T tends to infinity, and in the small-T-case, where T is a fixed natural number. The theoretical analysis of the paper is complemented by a simulation study which evaluates the finite sample performance of the estimator.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

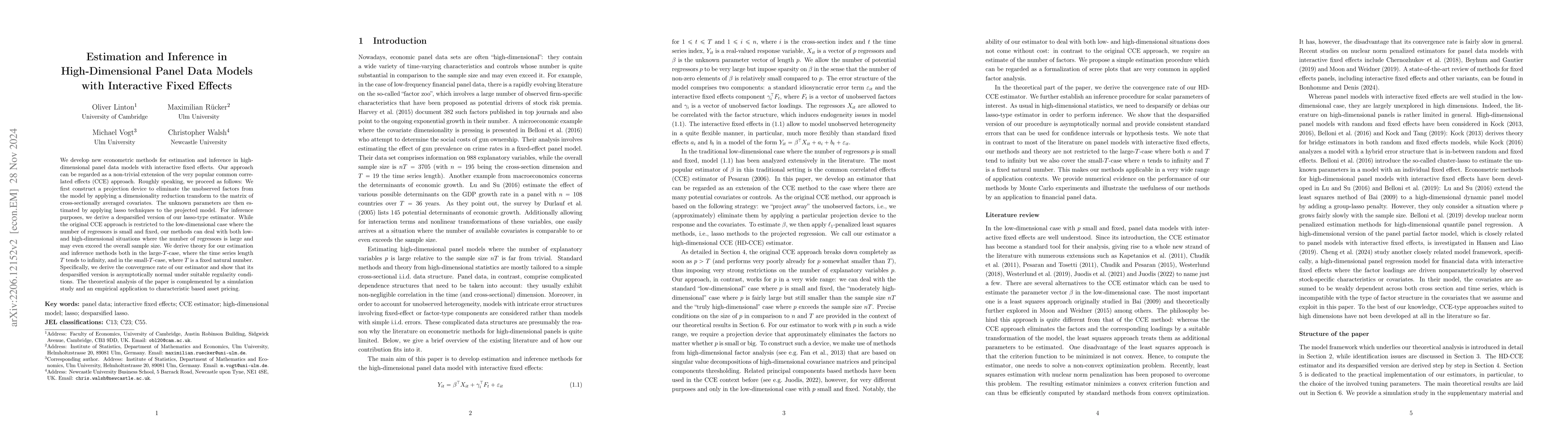

PDF Preview

Key Terms

Similar Papers

Found 4 papersDebiased Fixed Effects Estimation of Binary Logit Models with Three-Dimensional Panel Data

Amrei Stammann

Common Correlated Effects Estimation of Nonlinear Panel Data Models

Liang Chen, Minyuan Zhang

No citations found for this paper.

Comments (0)