Summary

The purpose of this paper is to review the concept of cryptocurrencies in our economy. First, Bitcoin and alternative cryptocurrencies' histories are analyzed. We then study the implementation of Bitcoin in the airline and real estate industries. Our study finds that many Bitcoin companies partner with airlines in order to decrease processing times, to provide ease of access for spending in international airports, and to reduce fees on foreign exchanges for fuel expenses, maintenance, and flight operations. Bitcoin transactions have occurred in the real estate industry, but many businesses are concerned with Bitcoin's potential interference with the U.S. government and its high volatility. As Bitcoin's price has been growing rapidly, we assessed Bitcoin's real value; Bitcoin derives value from its scarcity, utility, and public trust. In the conclusion, we discuss Bitcoin's future and conclude that Bitcoin may change from a short-term profit investment to a more steady industry as we identify Bitcoin with the "greater fool theory", and as the number of available Bitcoins to be mined dwindles and technology becomes more expensive.

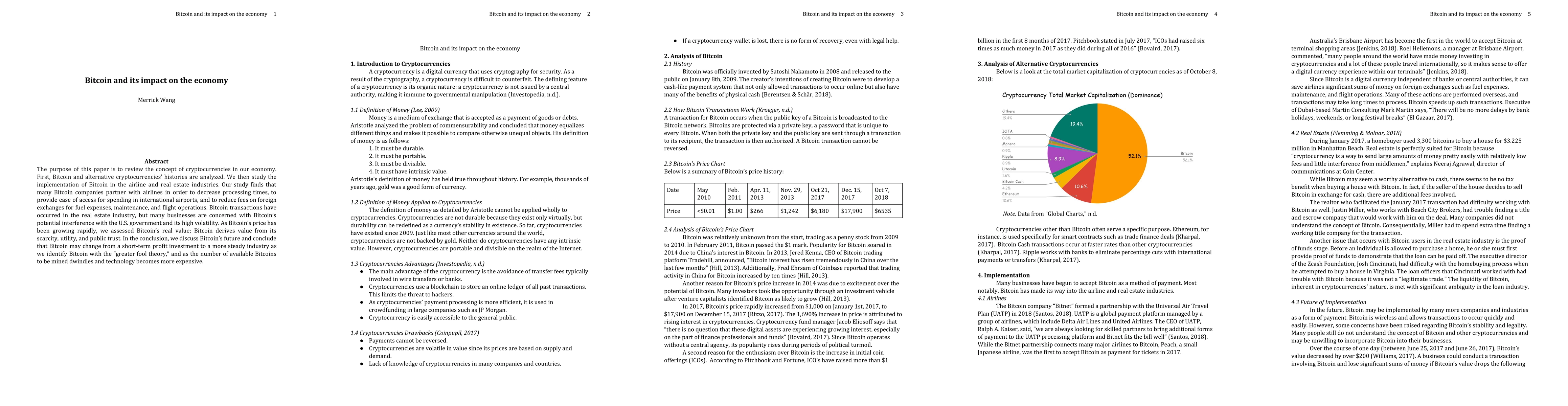

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBalancing Innovation and Sustainability: Addressing the Environmental Impact of Bitcoin Mining

Mohammad Ikbal Hossain, Tanja Steigner

| Title | Authors | Year | Actions |

|---|

Comments (0)