Authors

Summary

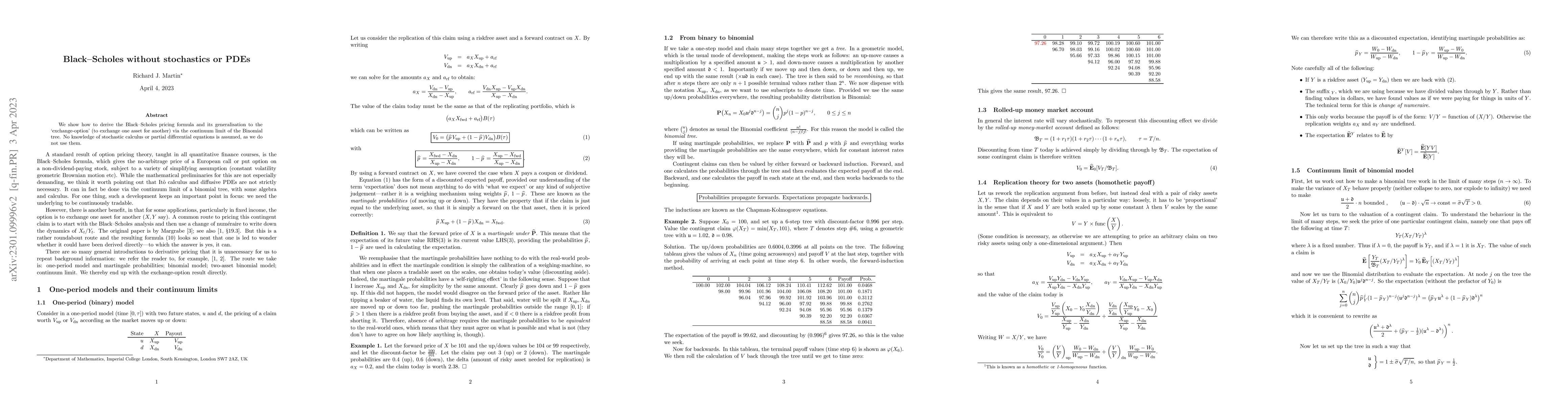

We show how to derive the Black-Scholes model and its generalisation to the `exchange-option' (to exchange one asset for another) via the continuum limit of the Binomial tree. No knowledge of stochastic calculus or partial differential equations is assumed, as we do not use them.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)