Authors

Summary

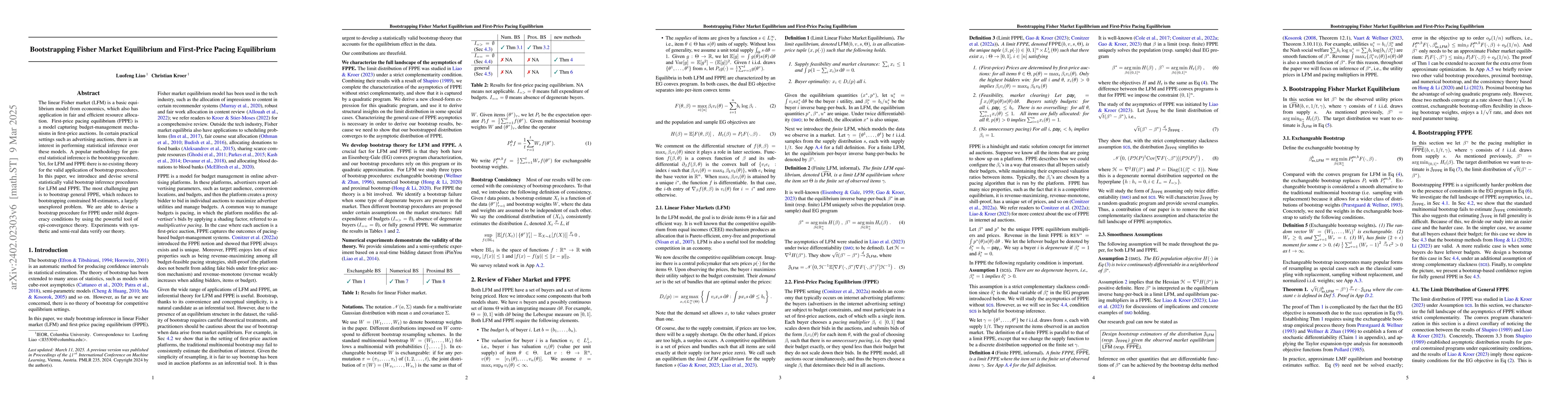

The linear Fisher market (LFM) is a basic equilibrium model from economics, which also has applications in fair and efficient resource allocation. First-price pacing equilibrium (FPPE) is a model capturing budget-management mechanisms in first-price auctions. In certain practical settings such as advertising auctions, there is an interest in performing statistical inference over these models. A popular methodology for general statistical inference is the bootstrap procedure. Yet, for LFM and FPPE there is no existing theory for the valid application of bootstrap procedures. In this paper, we introduce and devise several statistically valid bootstrap inference procedures for LFM and FPPE. The most challenging part is to bootstrap general FPPE, which reduces to bootstrapping constrained M-estimators, a largely unexplored problem. We devise a bootstrap procedure for FPPE under mild degeneracy conditions by using the powerful tool of epi-convergence theory. Experiments with synthetic and semi-real data verify our theory.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStatistical Inference for Fisher Market Equilibrium

Yuan Gao, Luofeng Liao, Christian Kroer

Price Competition in Linear Fisher Markets: Stability, Equilibrium and Personalization

Juncheng Li, Pingzhong Tang

| Title | Authors | Year | Actions |

|---|

Comments (0)