Summary

Mature internet advertising platforms offer high-level campaign management tools to help advertisers run their campaigns, often abstracting away the intricacies of how each ad is placed and focusing on aggregate metrics of interest to advertisers. On such platforms, advertisers often participate in auctions through a proxy bidder, so the standard incentive analyses that are common in the literature do not apply directly. In this paper, we take the perspective of a budget management system that surfaces aggregated incentives -- instead of individual auctions -- and compare first and second price auctions. We show that theory offers surprising endorsement for using a first price auction to sell individual impressions. In particular, first price auctions guarantee uniqueness of the steady-state equilibrium of the budget management system, monotonicity, and other desirable properties, as well as efficient computation through the solution to the well-studied Eisenberg-Gale convex program. Contrary to what one can expect from first price auctions, we show that incentives issues are not a barrier that undermines the system. Using realistic instances generated from data collected at real-world auction platforms, we show that bidders have small regret with respect to their optimal ex-post strategy, and they do not have a big incentive to misreport when they can influence equilibria directly by giving inputs strategically. Finally, budget-constrained bidders, who have significant prevalence in real-world platforms, tend to have smaller regrets. Our computations indicate that bidder budgets, pacing multipliers and regrets all have a positive association in statistical terms.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

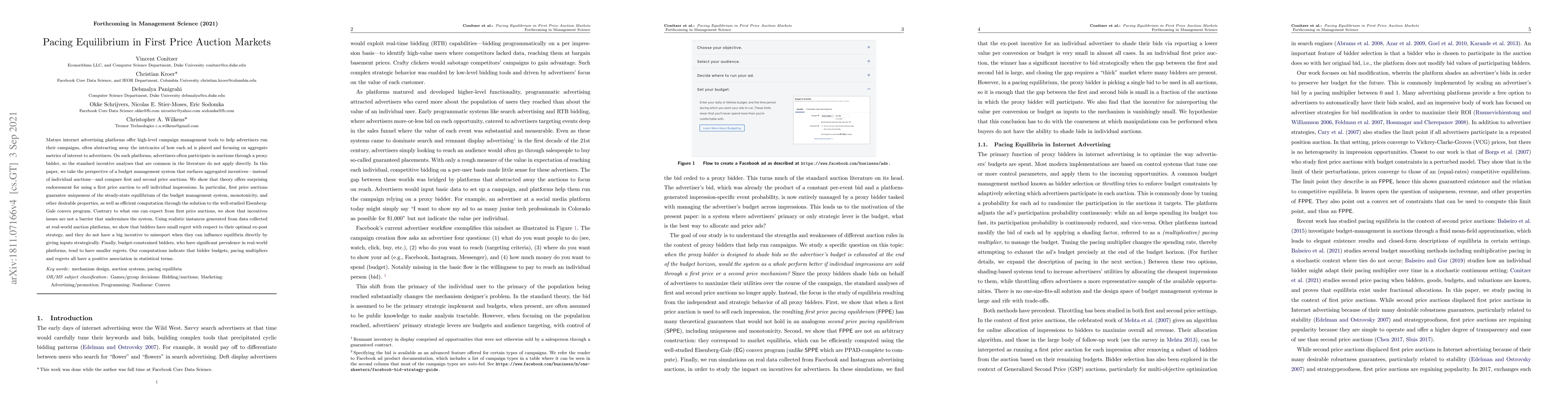

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBootstrapping Fisher Market Equilibrium and First-Price Pacing Equilibrium

Luofeng Liao, Christian Kroer

Statistical Inference and A/B Testing for First-Price Pacing Equilibria

Luofeng Liao, Christian Kroer

| Title | Authors | Year | Actions |

|---|

Comments (0)