Authors

Summary

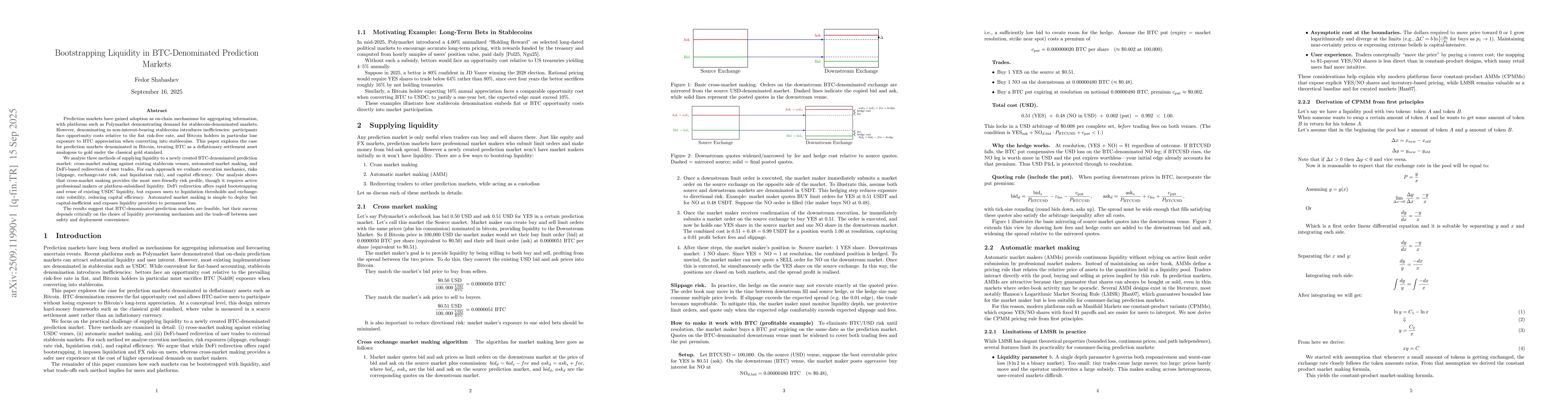

Prediction markets have gained adoption as on-chain mechanisms for aggregating information, with platforms such as Polymarket demonstrating demand for stablecoin-denominated markets. However, denominating in non-interest-bearing stablecoins introduces inefficiencies: participants face opportunity costs relative to the fiat risk-free rate, and Bitcoin holders in particular lose exposure to BTC appreciation when converting into stablecoins. This paper explores the case for prediction markets denominated in Bitcoin, treating BTC as a deflationary settlement asset analogous to gold under the classical gold standard. We analyse three methods of supplying liquidity to a newly created BTC-denominated prediction market: cross-market making against existing stablecoin venues, automated market making, and DeFi-based redirection of user trades. For each approach we evaluate execution mechanics, risks (slippage, exchange-rate risk, and liquidation risk), and capital efficiency. Our analysis shows that cross-market making provides the most user-friendly risk profile, though it requires active professional makers or platform-subsidised liquidity. DeFi redirection offers rapid bootstrapping and reuse of existing USDC liquidity, but exposes users to liquidation thresholds and exchange-rate volatility, reducing capital efficiency. Automated market making is simple to deploy but capital-inefficient and exposes liquidity providers to permanent loss. The results suggest that BTC-denominated prediction markets are feasible, but their success depends critically on the choice of liquidity provisioning mechanism and the trade-off between user safety and deployment convenience.

AI Key Findings

Generated Oct 02, 2025

Methodology

The paper evaluates three liquidity provisioning methods for BTC-denominated prediction markets: cross-market making, automated market making (AMM), and DeFi-based redirection of trades. It analyzes execution mechanics, risks (slippage, exchange-rate risk, liquidation risk), and capital efficiency for each approach.

Key Results

- Cross-market making offers the most user-friendly risk profile but requires active professional makers or platform-subsidized liquidity.

- DeFi redirection enables rapid bootstrapping using existing USDC liquidity but exposes users to collateral and exchange-rate risks, reducing capital efficiency.

- Automated market making (CPMM) is simple to deploy but capital-inefficient and exposes liquidity providers to permanent loss.

Significance

This research provides critical insights into building BTC-denominated prediction markets, which could enhance information aggregation while avoiding stablecoin-related inefficiencies. It highlights the trade-offs between user safety, deployment speed, and capital efficiency in different liquidity models.

Technical Contribution

The paper derives and analyzes the constant-product market making (CPMM) pricing rule for prediction markets, demonstrating its practical implementation and limitations compared to alternative approaches like LMSR.

Novelty

This work is novel in proposing BTC-denominated prediction markets as a deflationary settlement asset, analyzing specific liquidity bootstrapping mechanisms for Bitcoin-based markets, and quantifying the trade-offs between user safety, capital efficiency, and deployment convenience.

Limitations

- The analysis assumes ideal market conditions and may not account for extreme volatility or systemic risks.

- The paper focuses on technical mechanisms but does not extensively address regulatory or adoption challenges.

Future Work

- Exploring hybrid models that combine cross-market making with DeFi-based liquidity for better risk balance.

- Investigating dynamic liquidity provisioning mechanisms that adapt to market conditions in real-time.

- Analyzing the long-term impact of BTC-denominated markets on price discovery and information efficiency.

Paper Details

PDF Preview

Similar Papers

Found 4 papersDecentralized Prediction Markets and Sports Books

Zachary Feinstein, Hamed Amini, Maxim Bichuch

Comments (0)