Summary

We study a continuous-time version of the intermediation model of Grossman and Miller (1988). To wit, we solve for the competitive equilibrium prices at which liquidity takers' demands are absorbed by dealers with quadratic inventory costs, who can in turn gradually transfer these positions to an exogenous open market with finite liquidity. This endogenously leads to transient price impact in the dealer market. Smooth, diffusive, and discrete trades all incur finite but nontrivial liquidity costs, and can arise naturally from the liquidity takers' optimization.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

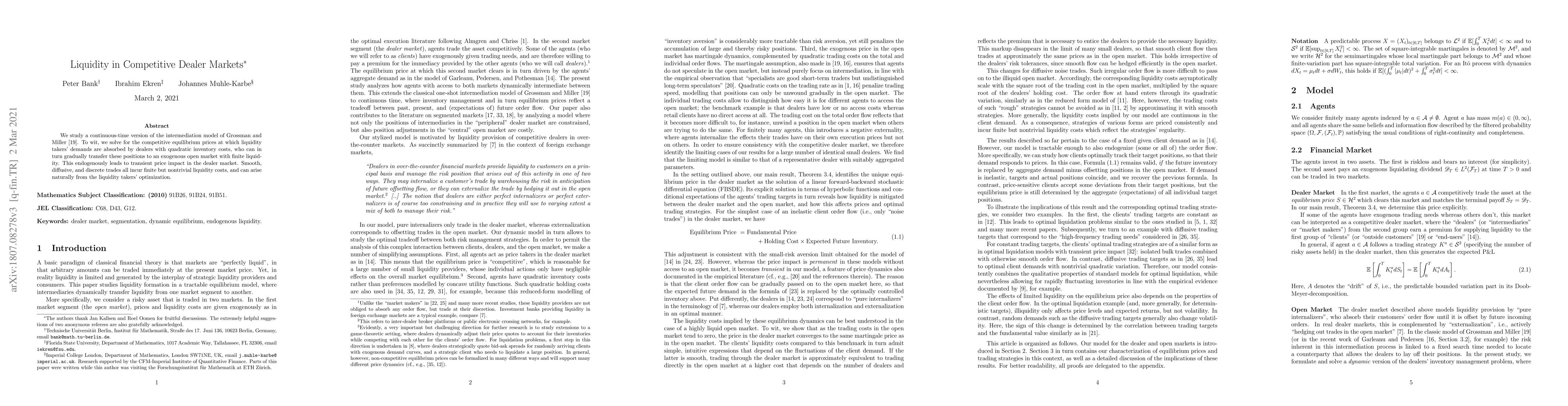

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAlgorithmic market making in dealer markets with hedging and market impact

Philippe Bergault, Olivier Guéant, Alexander Barzykin

| Title | Authors | Year | Actions |

|---|

Comments (0)