Summary

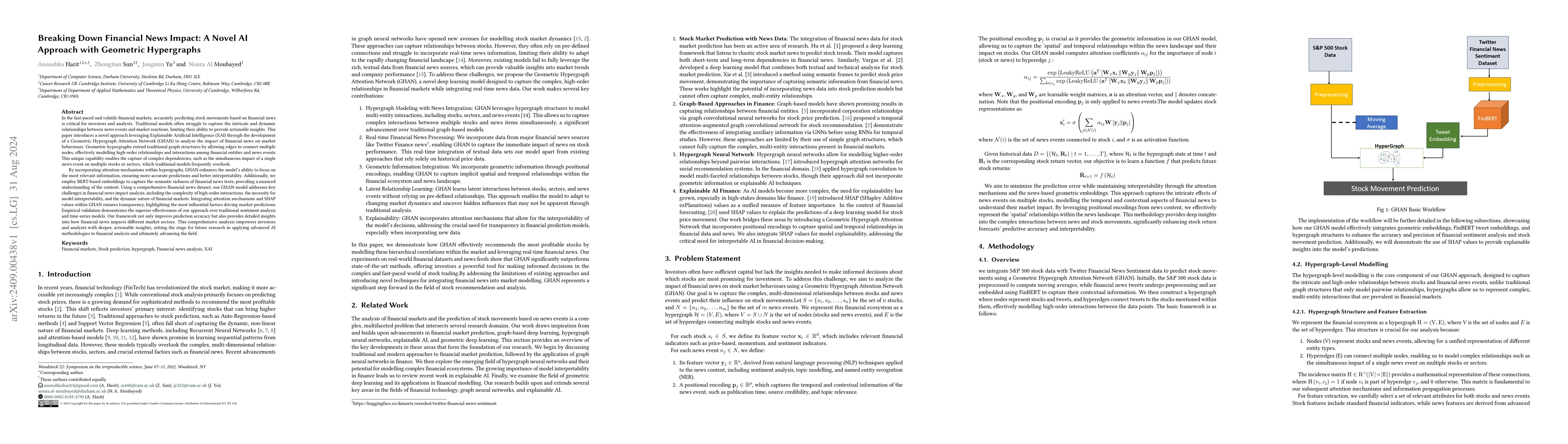

In the fast-paced and volatile financial markets, accurately predicting stock movements based on financial news is critical for investors and analysts. Traditional models often struggle to capture the intricate and dynamic relationships between news events and market reactions, limiting their ability to provide actionable insights. This paper introduces a novel approach leveraging Explainable Artificial Intelligence (XAI) through the development of a Geometric Hypergraph Attention Network (GHAN) to analyze the impact of financial news on market behaviours. Geometric hypergraphs extend traditional graph structures by allowing edges to connect multiple nodes, effectively modelling high-order relationships and interactions among financial entities and news events. This unique capability enables the capture of complex dependencies, such as the simultaneous impact of a single news event on multiple stocks or sectors, which traditional models frequently overlook. By incorporating attention mechanisms within hypergraphs, GHAN enhances the model's ability to focus on the most relevant information, ensuring more accurate predictions and better interpretability. Additionally, we employ BERT-based embeddings to capture the semantic richness of financial news texts, providing a nuanced understanding of the content. Using a comprehensive financial news dataset, our GHAN model addresses key challenges in financial news impact analysis, including the complexity of high-order interactions, the necessity for model interpretability, and the dynamic nature of financial markets. Integrating attention mechanisms and SHAP values within GHAN ensures transparency, highlighting the most influential factors driving market predictions. Empirical validation demonstrates the superior effectiveness of our approach over traditional sentiment analysis and time-series models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExtracting Structured Insights from Financial News: An Augmented LLM Driven Approach

Rian Dolphin, Joe Dursun, Jonathan Chow et al.

Blessing or curse? A survey on the Impact of Generative AI on Fake News

Alexander Loth, Martin Kappes, Marc-Oliver Pahl

No citations found for this paper.

Comments (0)