Summary

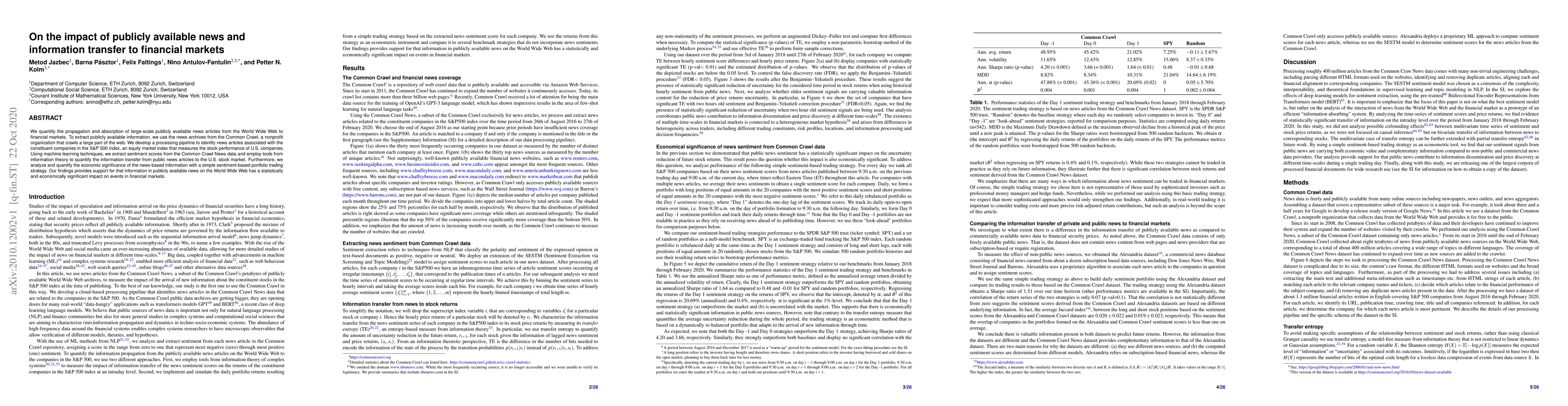

We quantify the propagation and absorption of large-scale publicly available news articles from the World Wide Web to financial markets. To extract publicly available information, we use the news archives from the Common Crawl, a nonprofit organization that crawls a large part of the web. We develop a processing pipeline to identify news articles associated with the constituent companies in the S\&P 500 index, an equity market index that measures the stock performance of U.S. companies. Using machine learning techniques, we extract sentiment scores from the Common Crawl News data and employ tools from information theory to quantify the information transfer from public news articles to the U.S. stock market. Furthermore, we analyze and quantify the economic significance of the news-based information with a simple sentiment-based portfolio trading strategy. Our findings provides support for that information in publicly available news on the World Wide Web has a statistically and economically significant impact on events in financial markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBreaking Down Financial News Impact: A Novel AI Approach with Geometric Hypergraphs

Noura Al Moubayed, Jongmin Yu, Anoushka Harit et al.

Narratives from GPT-derived Networks of News, and a link to Financial Markets Dislocations

Deborah Miori, Constantin Petrov

| Title | Authors | Year | Actions |

|---|

Comments (0)