Summary

We consider Lipschitz-type backward stochastic differential equations (BSDEs) driven by cylindrical martingales on the space of continuous functions. We show the existence and uniqueness of the solution of such infinite-dimensional BSDEs and prove that the sequence of solutions of corresponding finite-dimensional BSDEs approximates the original solution. We also consider the hedging problem in bond markets and prove that, for an approximately attainable contingent claim, the sequence of locally risk-minimizing strategies based on small markets converges to the generalized hedging strategy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

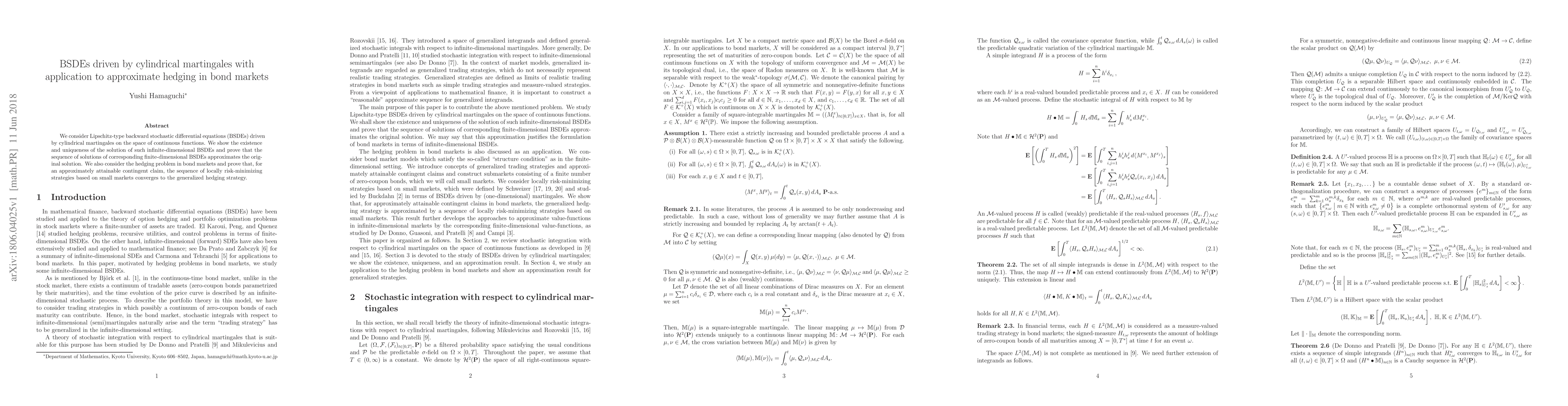

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBackward Stochastic Differential Equations (BSDEs) Using Infinite-dimensional Martingales with Subdifferential Operator

Pei Zhang, Adriana Irawati Nur Ibrahim, Nur Anisah Mohamed

| Title | Authors | Year | Actions |

|---|

Comments (0)