Summary

In Electricity markets, illiquidity, transaction costs and market price characteristics prevent managers to replicate exactly contracts. A residual risk is always present and the hedging strategy depends on a risk criterion chosen. We present an algorithm to hedge a position for a mean variance criterion taking into account the transaction cost and the small depth of the market. We show its effectiveness on a typical problem coming from the field of electricity markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

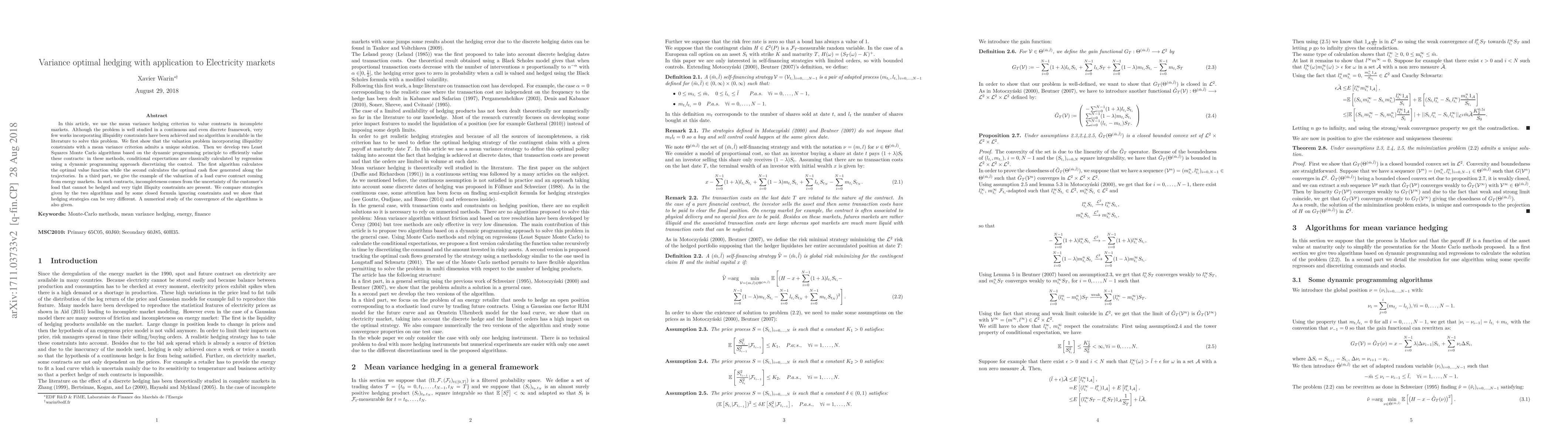

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)