Authors

Summary

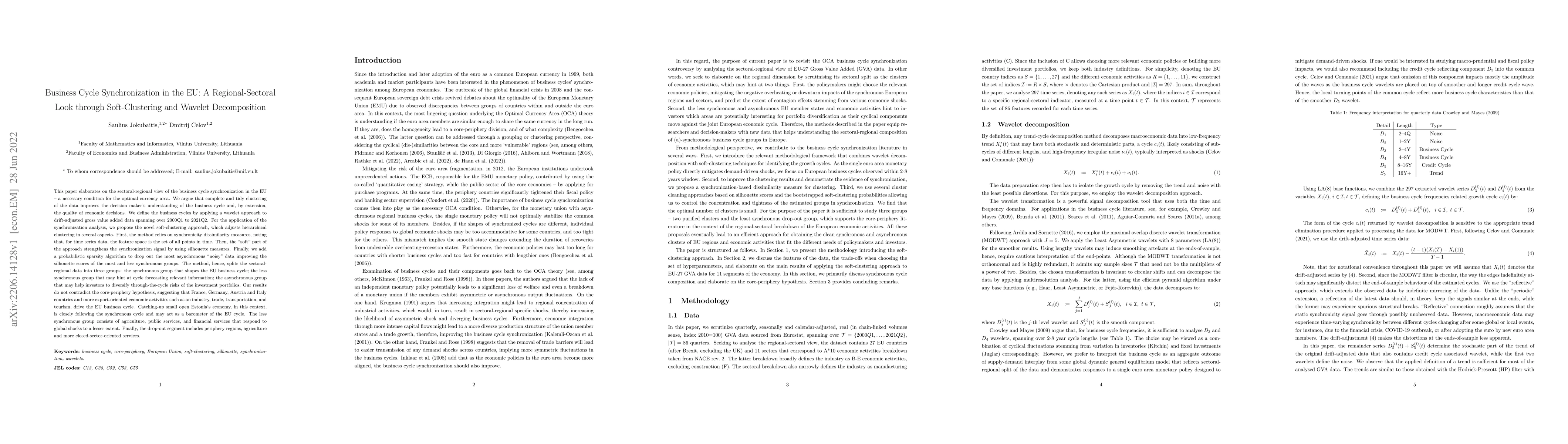

This paper elaborates on the sectoral-regional view of the business cycle synchronization in the EU -- a necessary condition for the optimal currency area. We argue that complete and tidy clustering of the data improves the decision maker's understanding of the business cycle and, by extension, the quality of economic decisions. We define the business cycles by applying a wavelet approach to drift-adjusted gross value added data spanning over 2000Q1 to 2021Q2. For the application of the synchronization analysis, we propose the novel soft-clustering approach, which adjusts hierarchical clustering in several aspects. First, the method relies on synchronicity dissimilarity measures, noting that, for time series data, the feature space is the set of all points in time. Then, the ``soft'' part of the approach strengthens the synchronization signal by using silhouette measures. Finally, we add a probabilistic sparsity algorithm to drop out the most asynchronous ``noisy'' data improving the silhouette scores of the most and less synchronous groups. The method, hence, splits the sectoral-regional data into three groups: the synchronous group that shapes the EU business cycle; the less synchronous group that may hint at cycle forecasting relevant information; the asynchronous group that may help investors to diversify through-the-cycle risks of the investment portfolios. The results support the core-periphery hypothesis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)