Summary

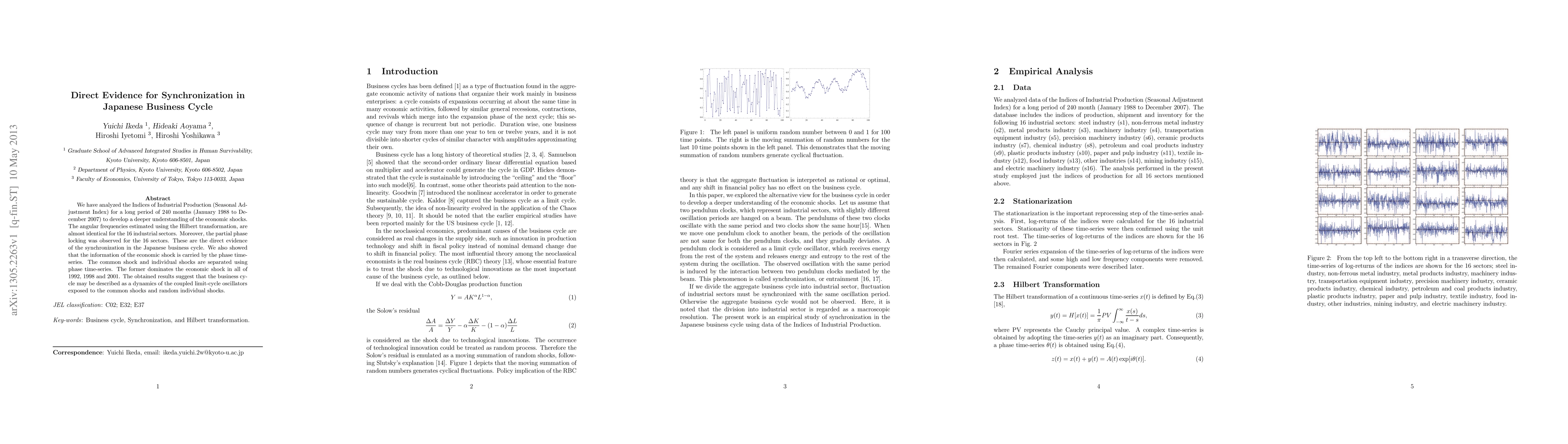

We have analyzed the Indices of Industrial Production (Seasonal Adjustment Index) for a long period of 240 months (January 1988 to December 2007) to develop a deeper understanding of the economic shocks. The angular frequencies estimated using the Hilbert transformation, are almost identical for the 16 industrial sectors. Moreover, the partial phase locking was observed for the 16 sectors. These are the direct evidence of the synchronization in the Japanese business cycle. We also showed that the information of the economic shock is carried by the phase time-series. The common shock and individual shocks are separated using phase time-series. The former dominates the economic shock in all of 1992, 1998 and 2001. The obtained results suggest that the business cycle may be described as a dynamics of the coupled limit-cycle oscillators exposed to the common shocks and random individual shocks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)