Summary

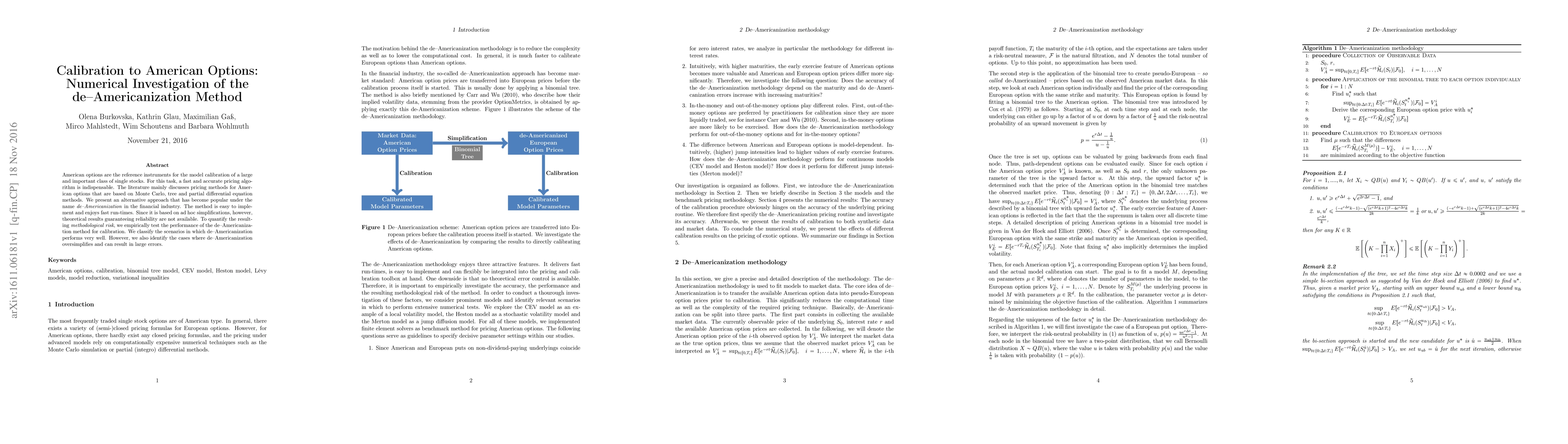

American options are the reference instruments for the model calibration of a large and important class of single stocks. For this task, a fast and accurate pricing algorithm is indispensable. The literature mainly discusses pricing methods for American options that are based on Monte Carlo, tree and partial differential equation methods. We present an alternative approach that has become popular under the name de-Americanization in the financial industry. The method is easy to implement and enjoys fast run-times. Since it is based on ad hoc simplifications, however, theoretical results guaranteeing reliability are not available. To quantify the resulting methodological risk, we empirically test the performance of the de-Americanization method for calibration. We classify the scenarios in which de-Americanization performs very well. However, we also identify the cases where de-Americanization oversimplifies and can result in large errors.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)