Summary

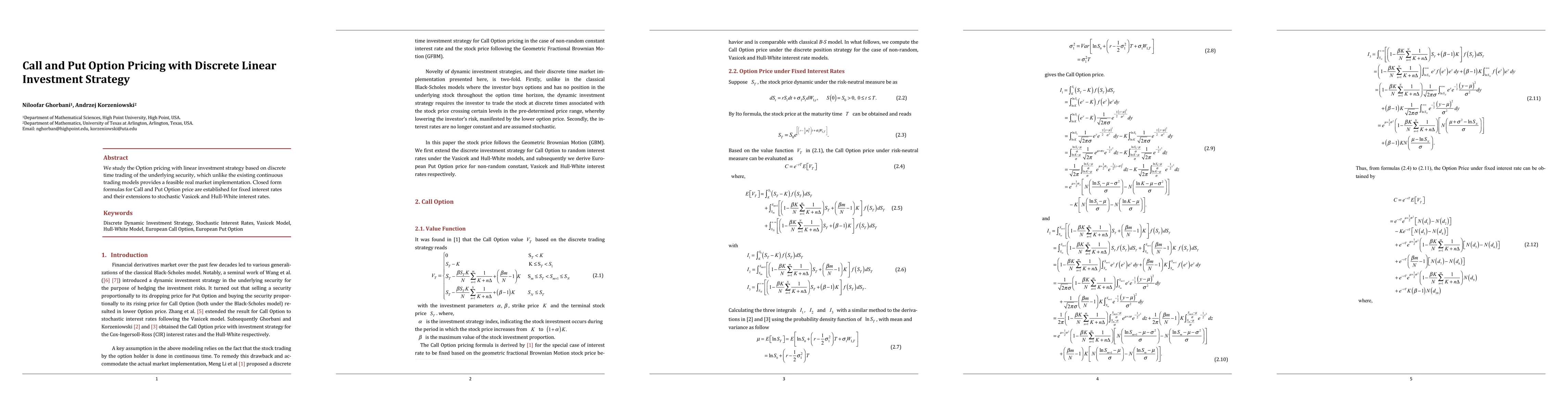

We study the Option pricing with linear investment strategy based on discrete time trading of the underlying security, which unlike the existing continuous trading models provides a feasible real market implementation. Closed form formulas for Call and Put Option price are established for fixed interest rates and their extensions to stochastic Vasicek and Hull-White interest rates.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPut-Call Parities, absence of arbitrage opportunities and non-linear pricing rules

Lorenzo Bastianello, Alain Chateauneuf, Bernard Cornet

ESG-valued discrete option pricing in complete markets

W. Brent Lindquist, Svetlozar T. Rachev, Yuan Hu

| Title | Authors | Year | Actions |

|---|

Comments (0)