Summary

If prices of assets traded in a financial market are determined by non-linear pricing rules, different versions of the Call-Put Parity have been considered. We show that, under monotonicity, parities between call and put options and discount certificates characterize ambiguity-sensitive (Choquet and/or Sipos) pricing rules, i.e., pricing rules that can be represented via discounted expectations with respect to non-additive probability measures. We analyze how non-additivity relates to arbitrage opportunities and we give necessary and sufficient conditions for Choquet and Sipos pricing rules to be arbitrage-free. Finally, we identify violations of the Call-Put Parity with the presence of bid-ask spreads.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

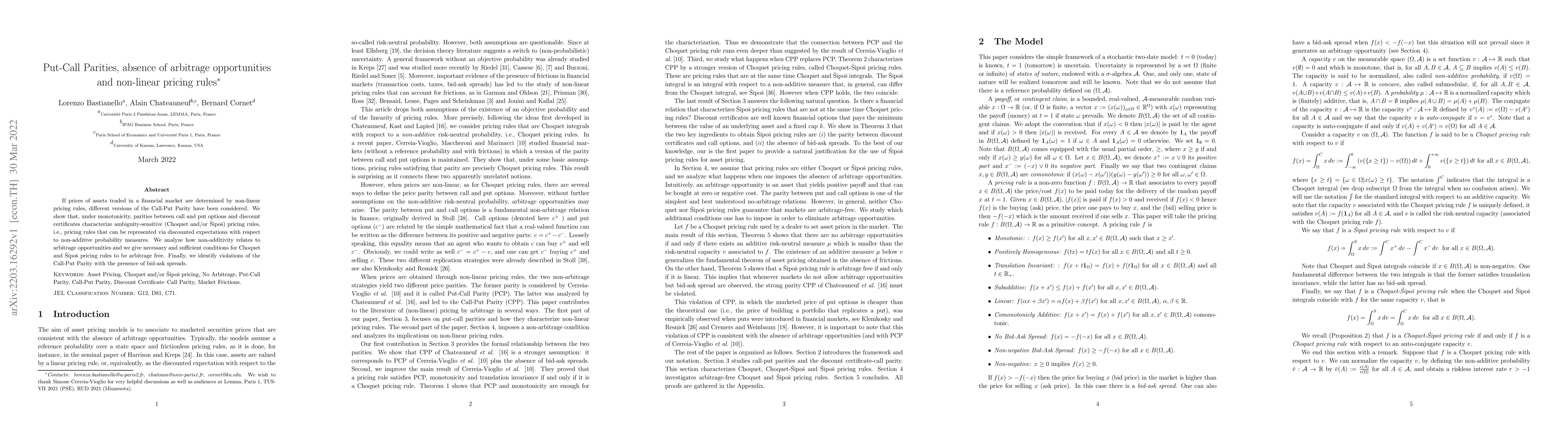

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCall and Put Option Pricing with Discrete Linear Investment Strategy

Andrzej Korzeniowski, Niloofar Ghorbani

| Title | Authors | Year | Actions |

|---|

Comments (0)