Summary

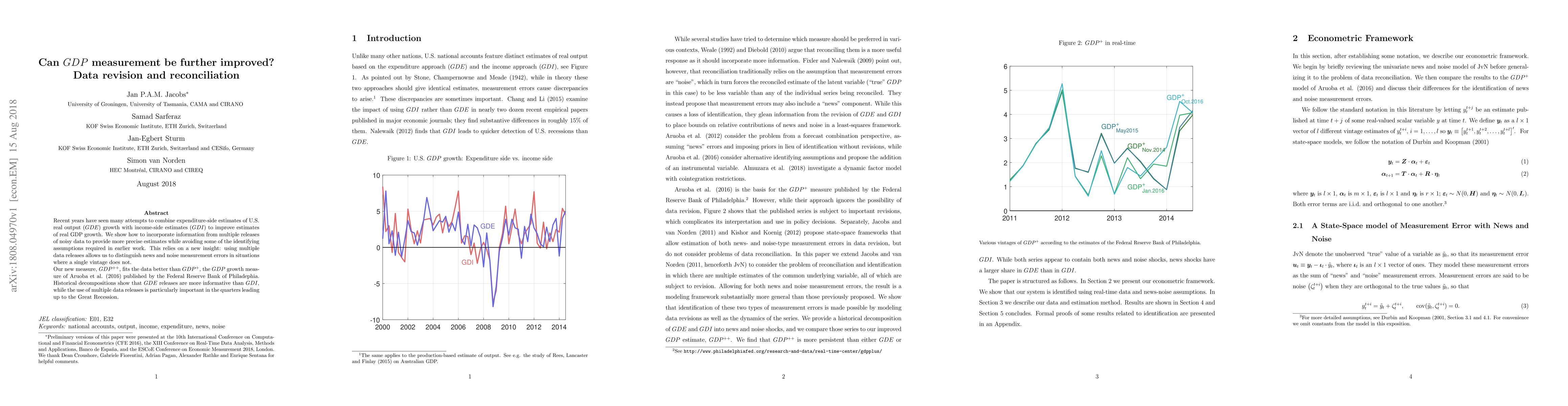

Recent years have seen many attempts to combine expenditure-side estimates of U.S. real output (GDE) growth with income-side estimates (GDI) to improve estimates of real GDP growth. We show how to incorporate information from multiple releases of noisy data to provide more precise estimates while avoiding some of the identifying assumptions required in earlier work. This relies on a new insight: using multiple data releases allows us to distinguish news and noise measurement errors in situations where a single vintage does not. Our new measure, GDP++, fits the data better than GDP+, the GDP growth measure of Aruoba et al. (2016) published by the Federal Reserve Bank of Philadephia. Historical decompositions show that GDE releases are more informative than GDI, while the use of multiple data releases is particularly important in the quarters leading up to the Great Recession.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)