Authors

Summary

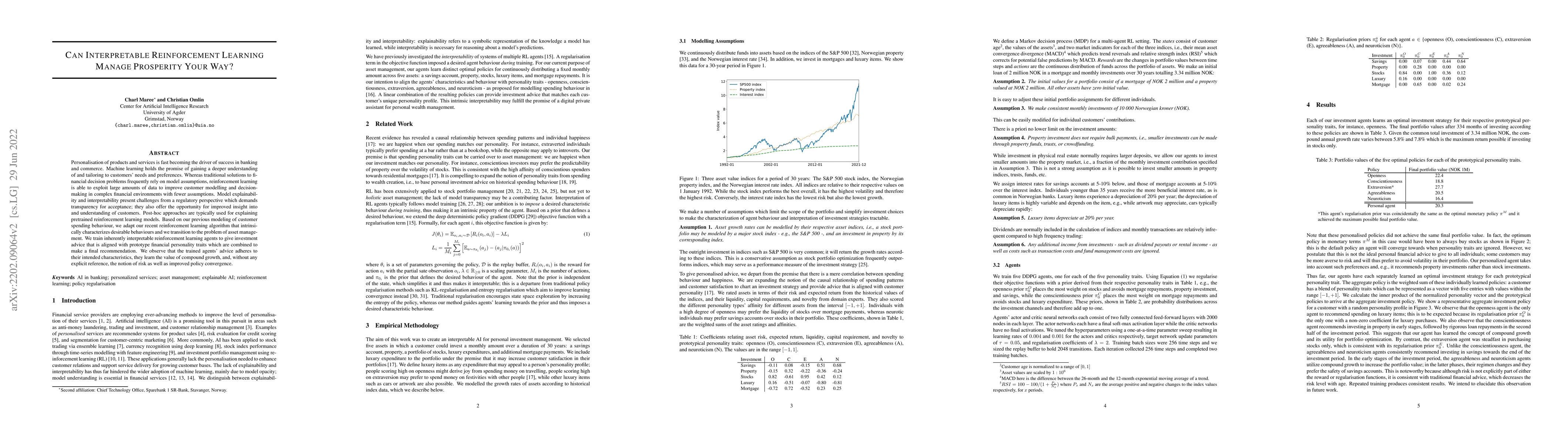

Personalisation of products and services is fast becoming the driver of success in banking and commerce. Machine learning holds the promise of gaining a deeper understanding of and tailoring to customers' needs and preferences. Whereas traditional solutions to financial decision problems frequently rely on model assumptions, reinforcement learning is able to exploit large amounts of data to improve customer modelling and decision-making in complex financial environments with fewer assumptions. Model explainability and interpretability present challenges from a regulatory perspective which demands transparency for acceptance; they also offer the opportunity for improved insight into and understanding of customers. Post-hoc approaches are typically used for explaining pretrained reinforcement learning models. Based on our previous modeling of customer spending behaviour, we adapt our recent reinforcement learning algorithm that intrinsically characterizes desirable behaviours and we transition to the problem of asset management. We train inherently interpretable reinforcement learning agents to give investment advice that is aligned with prototype financial personality traits which are combined to make a final recommendation. We observe that the trained agents' advice adheres to their intended characteristics, they learn the value of compound growth, and, without any explicit reference, the notion of risk as well as improved policy convergence.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersReinforcement Learning with Intrinsic Affinity for Personalized Prosperity Management

Charl Maree, Christian W. Omlin

A Survey on Interpretable Reinforcement Learning

Dong Li, Jianye Hao, Matthieu Zimmer et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)