Summary

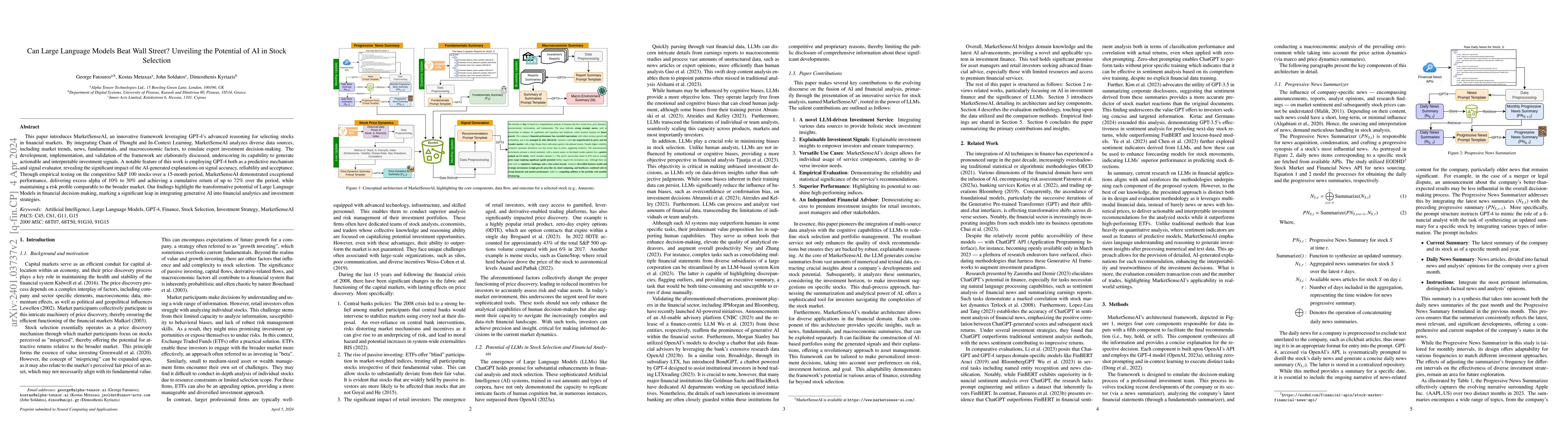

This paper introduces MarketSenseAI, an innovative framework leveraging GPT-4's advanced reasoning for selecting stocks in financial markets. By integrating Chain of Thought and In-Context Learning, MarketSenseAI analyzes diverse data sources, including market trends, news, fundamentals, and macroeconomic factors, to emulate expert investment decision-making. The development, implementation, and validation of the framework are elaborately discussed, underscoring its capability to generate actionable and interpretable investment signals. A notable feature of this work is employing GPT-4 both as a predictive mechanism and signal evaluator, revealing the significant impact of the AI-generated explanations on signal accuracy, reliability and acceptance. Through empirical testing on the competitive S&P 100 stocks over a 15-month period, MarketSenseAI demonstrated exceptional performance, delivering excess alpha of 10% to 30% and achieving a cumulative return of up to 72% over the period, while maintaining a risk profile comparable to the broader market. Our findings highlight the transformative potential of Large Language Models in financial decision-making, marking a significant leap in integrating generative AI into financial analytics and investment strategies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersUnveiling the Potential of Sentiment: Can Large Language Models Predict Chinese Stock Price Movements?

Chengjin Xu, Jian Guo, Haohan Zhang et al.

The Wall Street Neophyte: A Zero-Shot Analysis of ChatGPT Over MultiModal Stock Movement Prediction Challenges

Jimin Huang, Qianqian Xie, Min Peng et al.

Can ChatGPT Forecast Stock Price Movements? Return Predictability and Large Language Models

Alejandro Lopez-Lira, Yuehua Tang

| Title | Authors | Year | Actions |

|---|

Comments (0)