Summary

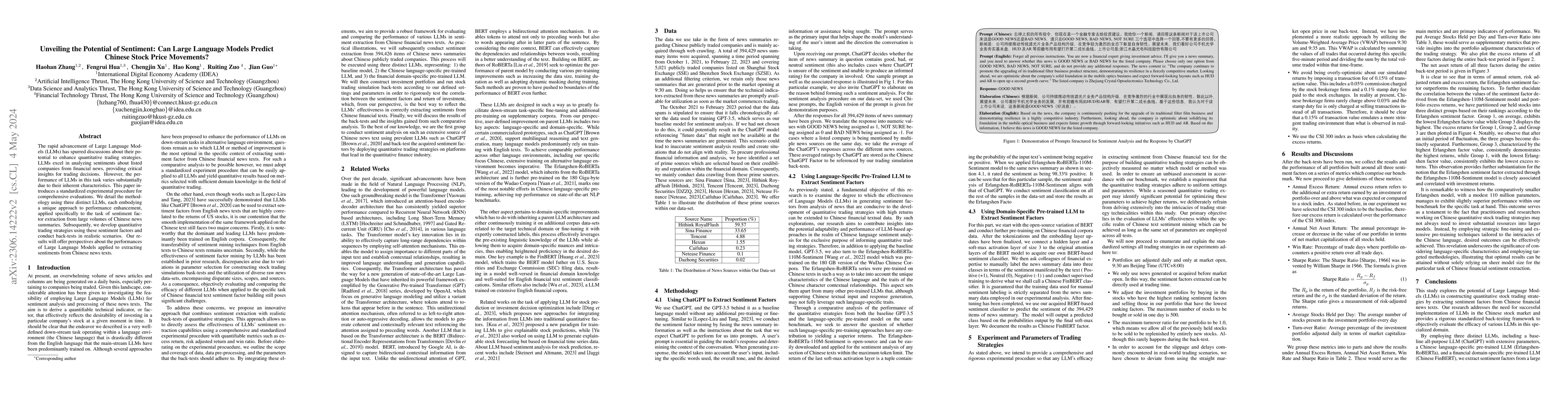

The rapid advancement of Large Language Models (LLMs) has spurred discussions about their potential to enhance quantitative trading strategies. LLMs excel in analyzing sentiments about listed companies from financial news, providing critical insights for trading decisions. However, the performance of LLMs in this task varies substantially due to their inherent characteristics. This paper introduces a standardized experimental procedure for comprehensive evaluations. We detail the methodology using three distinct LLMs, each embodying a unique approach to performance enhancement, applied specifically to the task of sentiment factor extraction from large volumes of Chinese news summaries. Subsequently, we develop quantitative trading strategies using these sentiment factors and conduct back-tests in realistic scenarios. Our results will offer perspectives about the performances of Large Language Models applied to extracting sentiments from Chinese news texts.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStonkBERT: Can Language Models Predict Medium-Run Stock Price Movements?

Stefan Pasch, Daniel Ehnes

Can ChatGPT Forecast Stock Price Movements? Return Predictability and Large Language Models

Alejandro Lopez-Lira, Yuehua Tang

| Title | Authors | Year | Actions |

|---|

Comments (0)