Authors

Summary

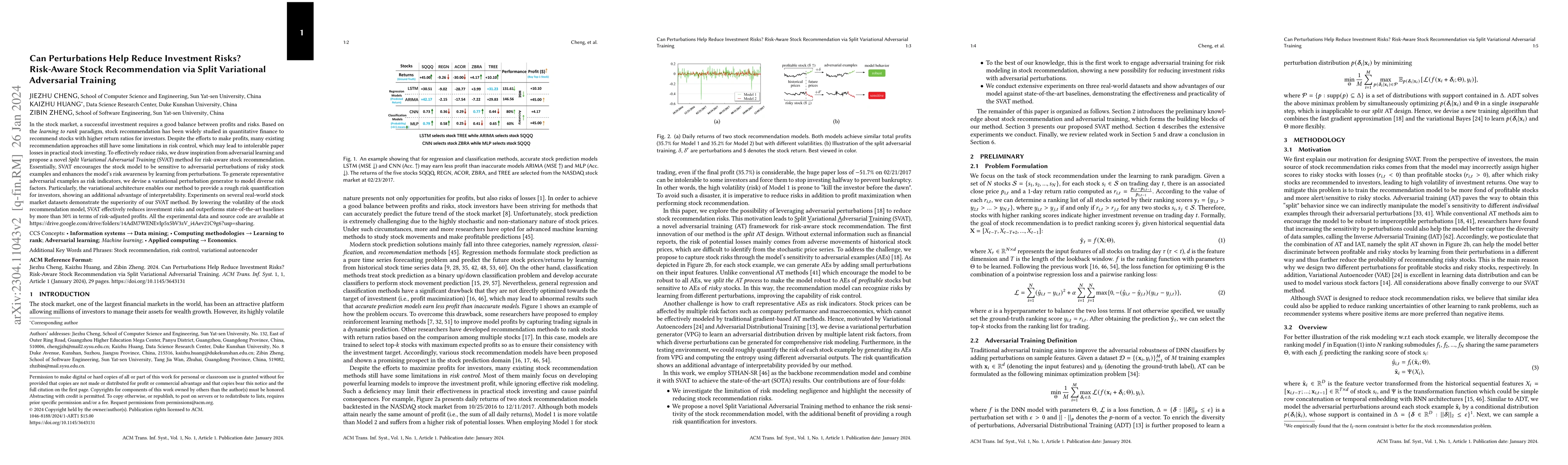

In the stock market, a successful investment requires a good balance between profits and risks. Based on the learning to rank paradigm, stock recommendation has been widely studied in quantitative finance to recommend stocks with higher return ratios for investors. Despite the efforts to make profits, many existing recommendation approaches still have some limitations in risk control, which may lead to intolerable paper losses in practical stock investing. To effectively reduce risks, we draw inspiration from adversarial learning and propose a novel Split Variational Adversarial Training (SVAT) method for risk-aware stock recommendation. Essentially, SVAT encourages the stock model to be sensitive to adversarial perturbations of risky stock examples and enhances the model's risk awareness by learning from perturbations. To generate representative adversarial examples as risk indicators, we devise a variational perturbation generator to model diverse risk factors. Particularly, the variational architecture enables our method to provide a rough risk quantification for investors, showing an additional advantage of interpretability. Experiments on several real-world stock market datasets demonstrate the superiority of our SVAT method. By lowering the volatility of the stock recommendation model, SVAT effectively reduces investment risks and outperforms state-of-the-art baselines by more than 30% in terms of risk-adjusted profits. All the experimental data and source code are available at https://drive.google.com/drive/folders/14AdM7WENEvIp5x5bV3zV_i4Aev21C9g6?usp=sharing.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRAGIC: Risk-Aware Generative Adversarial Model for Stock Interval Construction

Jingyi Gu, Guiling Wang, Wenlu Du

Enhancing Adversarial Robustness via Uncertainty-Aware Distributional Adversarial Training

Z. Jane Wang, Junhao Dong, Yew-Soon Ong et al.

MetaSplit: Meta-Split Network for Limited-Stock Product Recommendation

Bo Zheng, Wenhao Wu, Jialiang Zhou et al.

No citations found for this paper.

Comments (0)