Summary

We introduce capital flow constraints, loss of good will and loan to the lot sizing problem. Capital flow constraint is different from traditional capacity constraints: when a manufacturer launches production, its present capital should not be less than its present total production cost; otherwise, it must decrease production quantity or suspend production. Unsatisfied demand in one period may cause customer's demand to shrink in the next period considering loss of goodwill. Fixed loan can be adopted in the starting period for production. A mixed integer model for a deterministic single-item problem is constructed. Based on the analysis about the structure of optimal solutions, we approximate it to a traveling salesman problem, and divide it into sub-linear programming problems without integer variables. A forward recursive algorithm with heuristic adjustments is proposed to solve it. When unit variable production costs are equal and goodwill loss rate is zero, the algorithm can obtain optimal solutions. Under other situations, numerical comparisons with CPLEX 12.6.2 show our algorithm can reach optimal in most cases and has computation time advantage for large-size problems. Numerical tests also demonstrate that initial capital availability as well as loan interest rate can substantially affect the manufacturer's optimal lot sizing decisions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

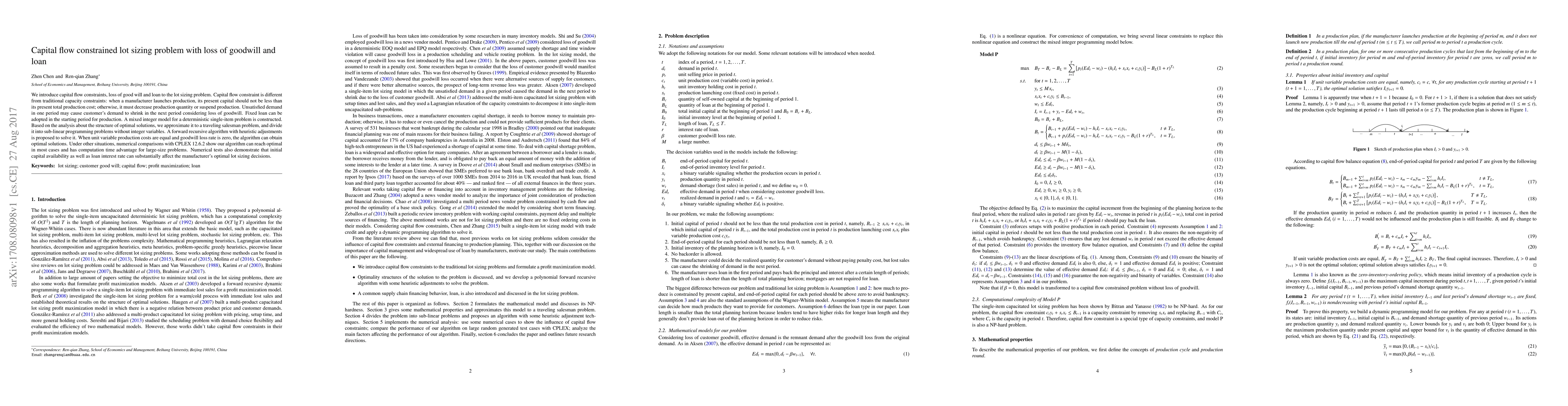

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)