Summary

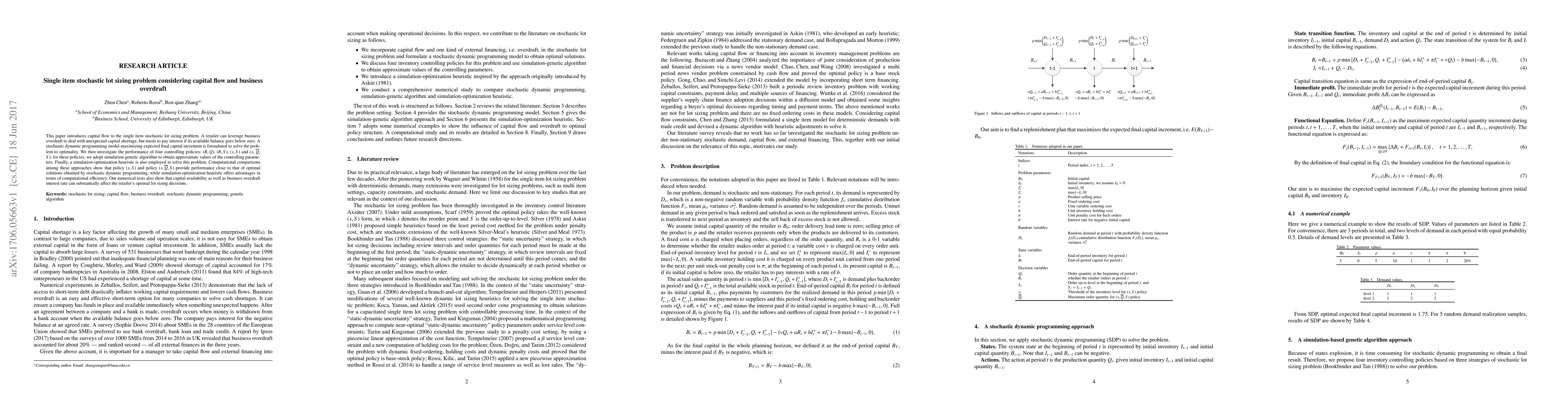

This paper introduces capital flow to the single item stochastic lot sizing problem. A retailer can leverage business overdraft to deal with unexpected capital shortage, but needs to pay interest if its available balance goes below zero. A stochastic dynamic programming model maximizing expected final capital increment is formulated to solve the problem to optimality. We then investigate the performance of four controlling policies: ($R, Q$), ($R, S$), ($s, S$) and ($s$, $\overline{Q}$, $S$); for these policies, we adopt simulation-genetic algorithm to obtain approximate values of the controlling parameters. Finally, a simulation-optimization heuristic is also employed to solve this problem. Computational comparisons among these approaches show that policy $(s, S)$ and policy $(s, \overline{Q}, S)$ provide performance close to that of optimal solutions obtained by stochastic dynamic programming, while simulation-optimization heuristic offers advantages in terms of computational efficiency. Our numerical tests also show that capital availability as well as business overdraft interest rate can substantially affect the retailer's optimal lot sizing decisions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)