Summary

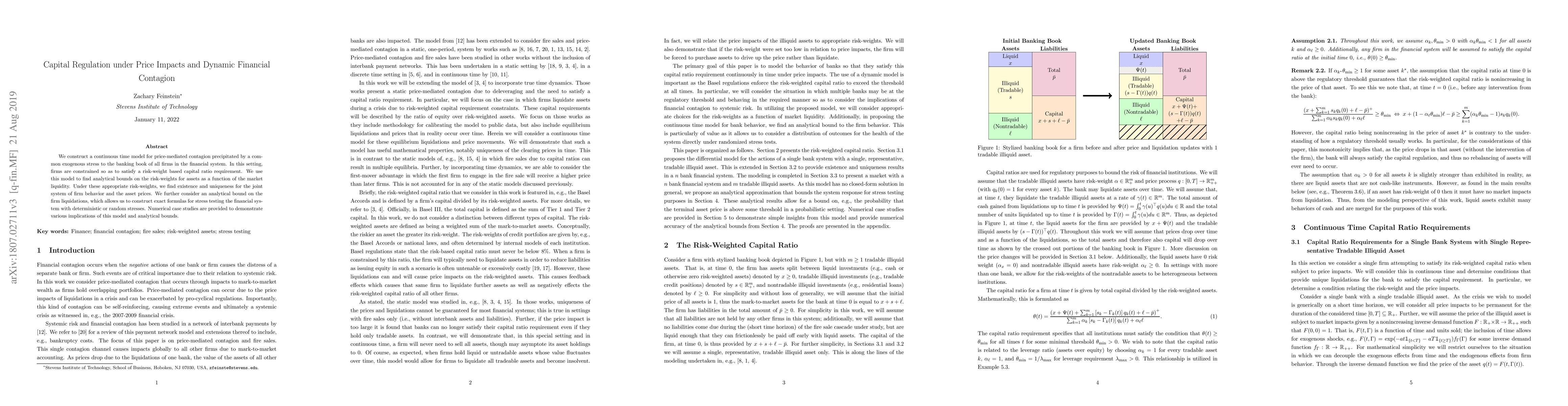

We construct a continuous time model for price-mediated contagion precipitated by a common exogenous stress to the banking book of all firms in the financial system. In this setting, firms are constrained so as to satisfy a risk-weight based capital ratio requirement. We use this model to find analytical bounds on the risk-weights for assets as a function of the market liquidity. Under these appropriate risk-weights, we find existence and uniqueness for the joint system of firm behavior and the asset prices. We further consider an analytical bound on the firm liquidations, which allows us to construct exact formulas for stress testing the financial system with deterministic or random stresses. Numerical case studies are provided to demonstrate various implications of this model and analytical bounds.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDynamic Clearing and Contagion in Financial Networks

Zachary Feinstein, Tathagata Banerjee, Alex Bernstein

| Title | Authors | Year | Actions |

|---|

Comments (0)