Summary

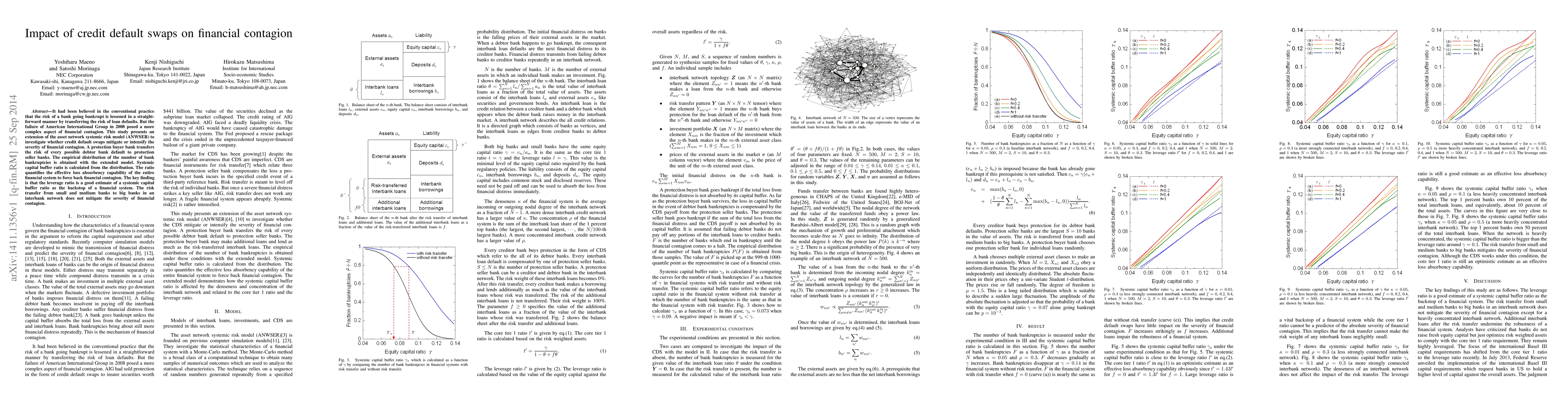

It had been believed in the conventional practice that the risk of a bank going bankrupt is lessened in a straightforward manner by transferring the risk of loan defaults. But the failure of American International Group in 2008 posed a more complex aspect of financial contagion. This study presents an extension of the asset network systemic risk model (ANWSER) to investigate whether credit default swaps mitigate or intensify the severity of financial contagion. A protection buyer bank transfers the risk of every possible debtor bank default to protection seller banks. The empirical distribution of the number of bank bankruptcies is obtained with the extended model. Systemic capital buffer ratio is calculated from the distribution. The ratio quantifies the effective loss absorbency capability of the entire financial system to force back financial contagion. The key finding is that the leverage ratio is a good estimate of a systemic capital buffer ratio as the backstop of a financial system. The risk transfer from small and medium banks to big banks in an interbank network does not mitigate the severity of financial contagion.

AI Key Findings

Generated Sep 02, 2025

Methodology

The study extends the asset network systemic risk model (ANWSER) to analyze the impact of credit default swaps (CDS) on financial contagion, comparing financial systems with and without risk transfer.

Key Results

- The leverage ratio is a good estimate of systemic capital buffer ratio as the backstop of a financial system.

- Risk transfer from small and medium banks to big banks in an interbank network does not mitigate the severity of financial contagion.

- Additional interbank loans after risk transfer undermine the robustness of a financial system.

Significance

This research is important as it examines the effectiveness of CDS in reducing financial contagion, providing insights for regulators and policymakers to design better financial systems.

Technical Contribution

The extension of the ANWSER model to include CDS and the calculation of systemic capital buffer ratio as a measure of financial system resilience.

Novelty

This work differs from previous research by focusing on the role of CDS in financial contagion and quantifying the systemic capital buffer ratio, providing a more nuanced understanding of risk transfer mechanisms in banking systems.

Limitations

- The study assumes that failing debtor banks do not pay off any portion of interbank loans to creditor banks.

- It does not consider the impact of regulatory changes or market reactions to CDS usage.

Future Work

- Investigate the impact of varying CDS contract terms and conditions on financial contagion.

- Explore the effects of different interbank network topologies and risk transfer patterns.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)