Authors

Summary

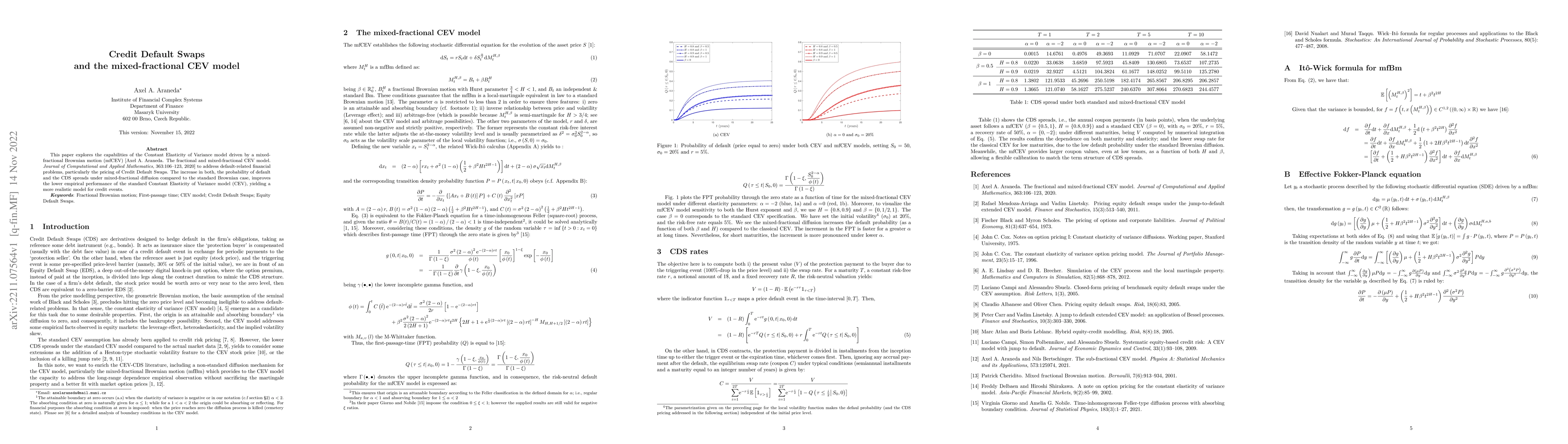

This paper explores the capabilities of the Constant Elasticity of Variance model driven by a mixed-fractional Brownian motion (mfCEV) [Axel A. Araneda. The fractional and mixed-fractional CEV model. Journal of Computational and Applied Mathematics, 363:106-123, 2020] to address default-related financial problems, particularly the pricing of Credit Default Swaps. The increase in both, the probability of default and the CDS spreads under mixed-fractional diffusion compared to the standard Brownian case, improves the lower empirical performance of the standard Constant Elasticity of Variance model (CEV), yielding a more realistic model for credit events.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)