Summary

In this paper, we propose a dynamical model to capture cascading failures among interconnected organizations in the global financial system. Failures can take the form of bankruptcies, defaults, and other insolvencies. The network that underpins the financial interdependencies between different organizations constitutes the backbone of the financial system. A failure in one or more of these organizations can lead the propagation of the financial collapse onto other organizations in a domino effect. Paramount importance is therefore given to the mitigation of these failures. Motivated by the relevance of this problem and recent prominent events connected to it, we develop a framework that allows us to investigate under what conditions organizations remain healthy or are involved in the propagation of the failures in the network. The contribution of this paper is the following: i) we develop a dynamical model that describes the equity values of financial organizations and their evolution over time given an initial condition; ii) we characterize the equilibria for this model by proving the existence and uniqueness of these equilibria, and by providing an explicit expression for them; and iii) we provide a computational method via sign-space iteration to analyze the propagation of failures and the attractive equilibrium point.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

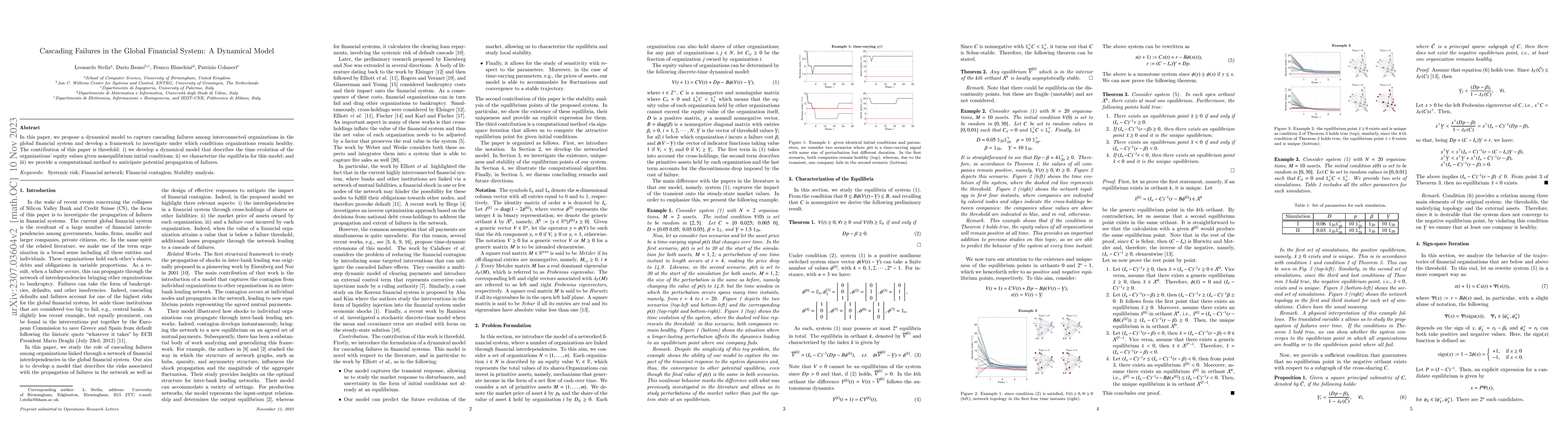

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersQuantitative, Data-driven Network Model for Global Cascading Financial Failure

David Denkenberger, Łukasz G. Gajewski, Michael Hinge

Control of cascading failures in dynamical models of power grids

Lucia Valentina Gambuzza, Mattia Frasca

| Title | Authors | Year | Actions |

|---|

Comments (0)