Summary

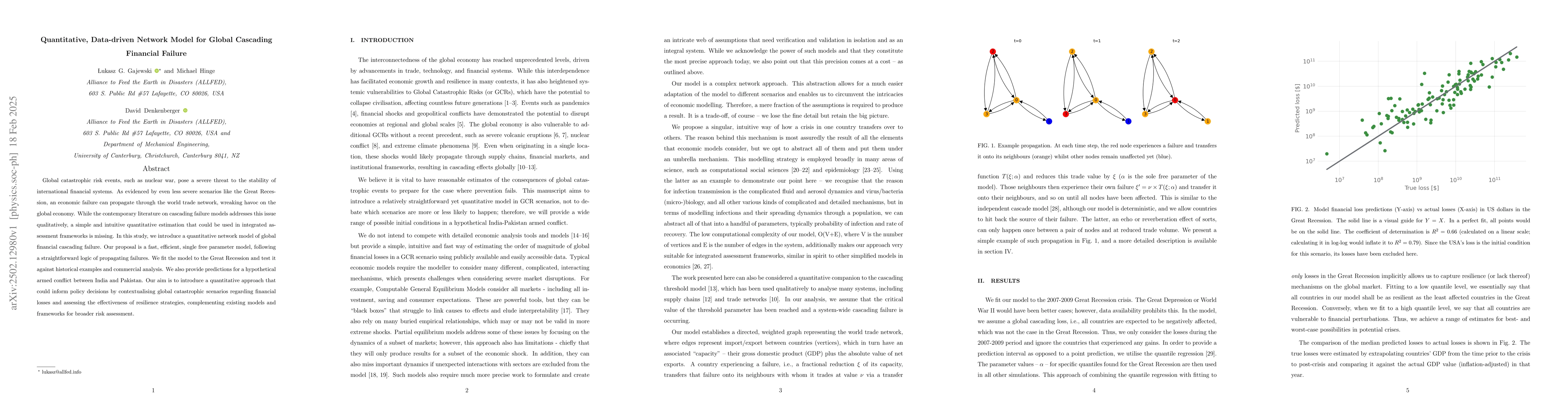

Global catastrophic risk events, such as nuclear war, pose a severe threat to the stability of international financial systems. As evidenced by even less severe scenarios like the Great Recession, an economic failure can propagate through the world trade network, wreaking havoc on the global economy. While the contemporary literature on cascading failure models addresses this issue qualitatively, a simple and intuitive quantitative estimation that could be used in integrated assessment frameworks is missing. In this study, we introduce a quantitative network model of global financial cascading failure. Our proposal is a fast, efficient, single free parameter model, following a straightforward logic of propagating failures. We fit the model to the Great Recession and test it against historical examples and commercial analysis. We also provide predictions for a hypothetical armed conflict between India and Pakistan. Our aim is to introduce a quantitative approach that could inform policy decisions by contextualising global catastrophic scenarios regarding financial losses and assessing the effectiveness of resilience strategies, complementing existing models and frameworks for broader risk assessment.

AI Key Findings

Generated Jun 11, 2025

Methodology

The research introduces a quantitative network model for global cascading financial failure, utilizing trading data from the IMF, GDP data from the World Bank, and a single free parameter model to simulate failure propagation across a world trade network.

Key Results

- A fast, efficient, single free parameter model for estimating global financial cascading failure.

- Model successfully fitted to the Great Recession and tested against historical examples and commercial analysis.

- Predictions provided for a hypothetical armed conflict between India and Pakistan.

- Model aims to inform policy decisions by contextualizing global catastrophic scenarios and assessing resilience strategies.

Significance

This quantitative approach complements existing models and frameworks for broader risk assessment, providing a simple and intuitive estimation of financial losses in catastrophic scenarios.

Technical Contribution

The paper proposes a deterministic, quantitative cascading failure model with a transfer function that quantifies one country's financial loss transfer to its trading partners.

Novelty

The research offers a novel quantitative, data-driven network model for global cascading financial failure, contrasting with existing qualitative models and agent-based approaches.

Limitations

- Model assumes linear extrapolation for estimating GDP losses, which may not be accurate for long-term trends.

- Data availability constraints may affect the list of countries included in each scenario analysis.

Future Work

- Explore more sophisticated and country-tailored approaches for estimating GDP losses.

- Investigate the impact of varying timespans on model performance and accuracy.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCascading Failures in the Global Financial System: A Dynamical Model

Leonardo Stella, Franco Blanchini, Dario Bauso et al.

Data-Driven Interaction Analysis of Line Failure Cascading in Power Grid Networks

Holger Kantz, Abdorasoul Ghasemi

No citations found for this paper.

Comments (0)