Authors

Summary

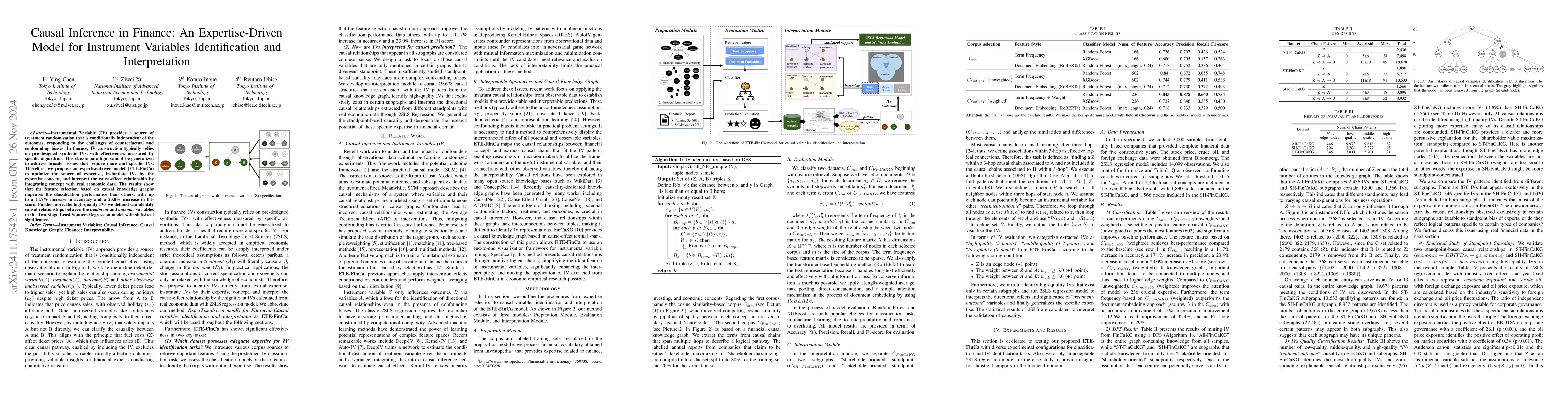

Instrumental Variable (IV) provides a source of treatment randomization that is conditionally independent of the outcomes, responding to the challenges of counterfactual and confounding biases. In finance, IV construction typically relies on pre-designed synthetic IVs, with effectiveness measured by specific algorithms. This classic paradigm cannot be generalized to address broader issues that require more and specific IVs. Therefore, we propose an expertise-driven model (ETE-FinCa) to optimize the source of expertise, instantiate IVs by the expertise concept, and interpret the cause-effect relationship by integrating concept with real economic data. The results show that the feature selection based on causal knowledge graphs improves the classification performance than others, with up to a 11.7% increase in accuracy and a 23.0% increase in F1-score. Furthermore, the high-quality IVs we defined can identify causal relationships between the treatment and outcome variables in the Two-Stage Least Squares Regression model with statistical significance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCausal Inference for Banking Finance and Insurance A Survey

Yelleti Vivek, Vadlamani Ravi, Satyam Kumar et al.

Mendelian Randomization Methods for Causal Inference: Estimands, Identification and Inference

Zhonghua Liu, Anqi Wang, Xihao Li et al.

Ancestral Instrument Method for Causal Inference without Complete Knowledge

Lin Liu, Jixue Liu, Jiuyong Li et al.

Causal GNNs: A GNN-Driven Instrumental Variable Approach for Causal Inference in Networks

Xiaojing Du, Wentao Gao, Xiongren Chen et al.

No citations found for this paper.

Comments (0)