Authors

Summary

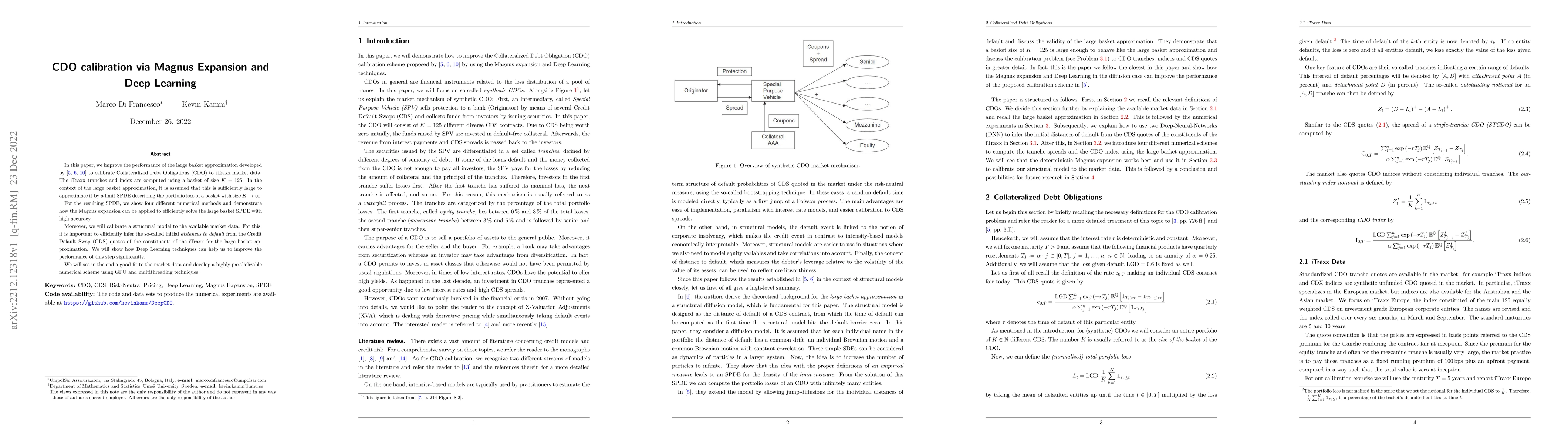

In this paper, we improve the performance of the large basket approximation developed by Reisinger et al. to calibrate Collateralized Debt Obligations (CDO) to iTraxx market data. The iTraxx tranches and index are computed using a basket of size $K= 125$. In the context of the large basket approximation, it is assumed that this is sufficiently large to approximate it by a limit SPDE describing the portfolio loss of a basket with size $K\rightarrow \infty$. For the resulting SPDE, we show four different numerical methods and demonstrate how the Magnus expansion can be applied to efficiently solve the large basket SPDE with high accuracy. Moreover, we will calibrate a structural model to the available market data. For this, it is important to efficiently infer the so-called initial distances to default from the Credit Default Swap (CDS) quotes of the constituents of the iTraxx for the large basket approximation. We will show how Deep Learning techniques can help us to improve the performance of this step significantly. We will see in the end a good fit to the market data and develop a highly parallelizable numerical scheme using GPU and multithreading techniques.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersWhat is the Magnus Expansion?

Kurusch Ebrahimi-Fard, Igor Mencattini, Alexandre Quesney

Time-dependent Hamiltonian Simulation via Magnus Expansion: Algorithm and Superconvergence

Di Fang, Diyi Liu, Rahul Sarkar

No citations found for this paper.

Comments (0)