Summary

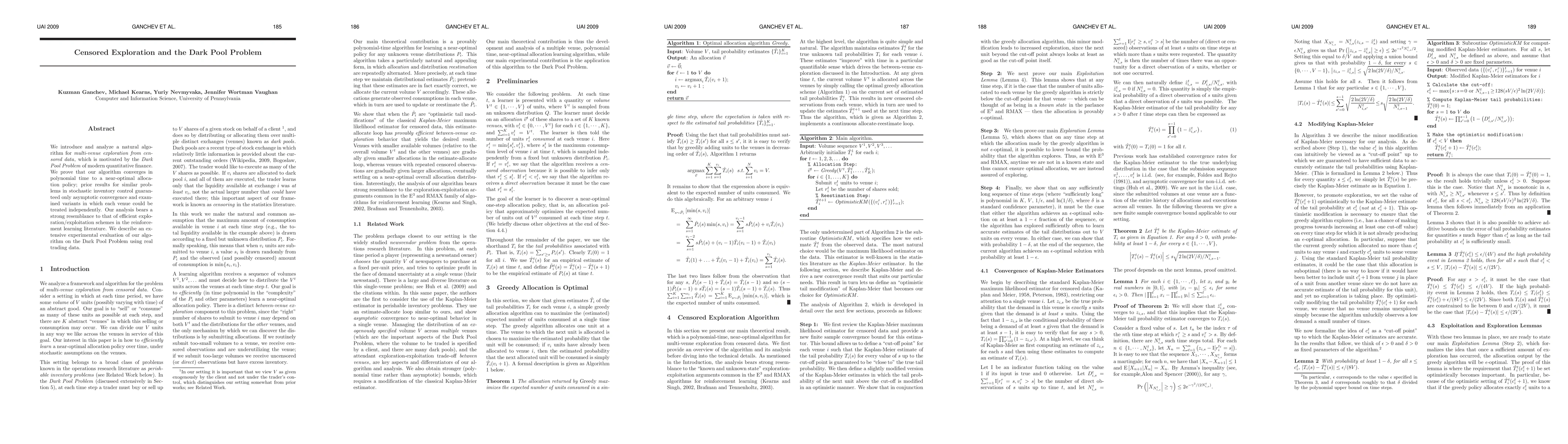

We introduce and analyze a natural algorithm for multi-venue exploration from censored data, which is motivated by the Dark Pool Problem of modern quantitative finance. We prove that our algorithm converges in polynomial time to a near-optimal allocation policy; prior results for similar problems in stochastic inventory control guaranteed only asymptotic convergence and examined variants in which each venue could be treated independently. Our analysis bears a strong resemblance to that of efficient exploration/ exploitation schemes in the reinforcement learning literature. We describe an extensive experimental evaluation of our algorithm on the Dark Pool Problem using real trading data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)