Summary

For a market impact model, price manipulation and related notions play a role that is similar to the role of arbitrage in a derivatives pricing model. Here, we give a systematic investigation into such regularity issues when orders can be executed both at a traditional exchange and in a dark pool. To this end, we focus on a class of dark-pool models whose market impact at the exchange is described by an Almgren--Chriss model. Conditions for the absence of price manipulation for all Almgren--Chriss models include the absence of temporary cross-venue impact, the presence of full permanent cross-venue impact, and the additional penalization of orders executed in the dark pool. When a particular Almgren--Chriss model has been fixed, we show by a number of examples that the regularity of the dark-pool model hinges in a subtle way on the interplay of all model parameters and on the liquidation time constraint. The paper can also be seen as a case study for the regularity of market impact models in general.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

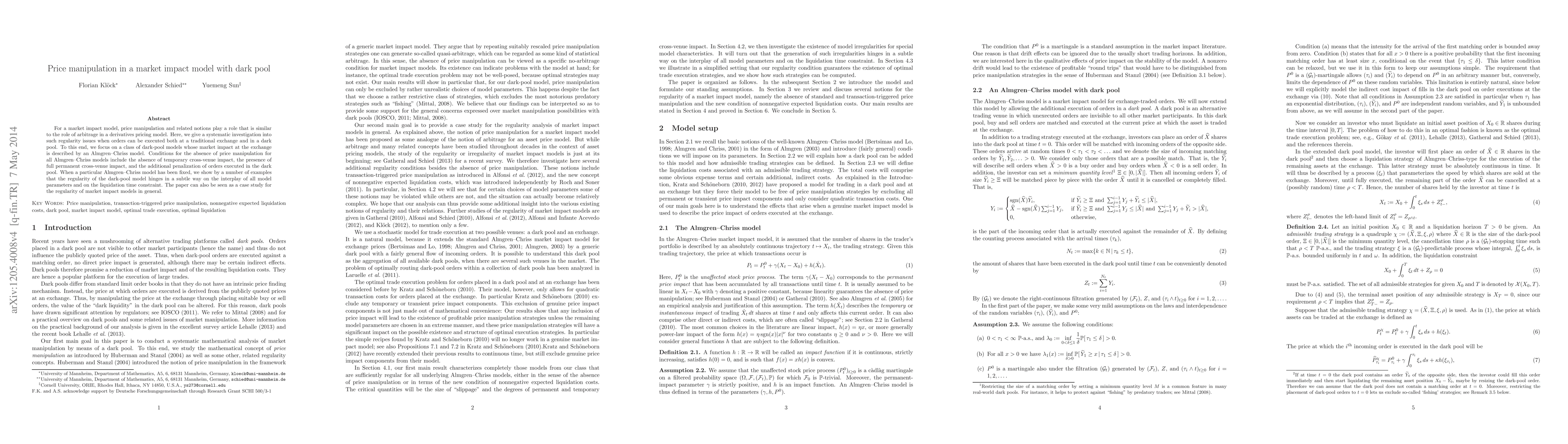

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)