Summary

We consider the stochastic control problem of a financial trader that needs to unwind a large asset portfolio within a short period of time. The trader can simultaneously submit active orders to a primary market and passive orders to a dark pool. Our framework is flexible enough to allow for price-dependent impact functions describing the trading costs in the primary market and price-dependent adverse selection costs associated with dark pool trading. We prove that the value function can be characterized in terms of the unique smooth solution to a PDE with singular terminal value, establish its explicit asymptotic behavior at the terminal time, and give the optimal trading strategy in feedback form.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

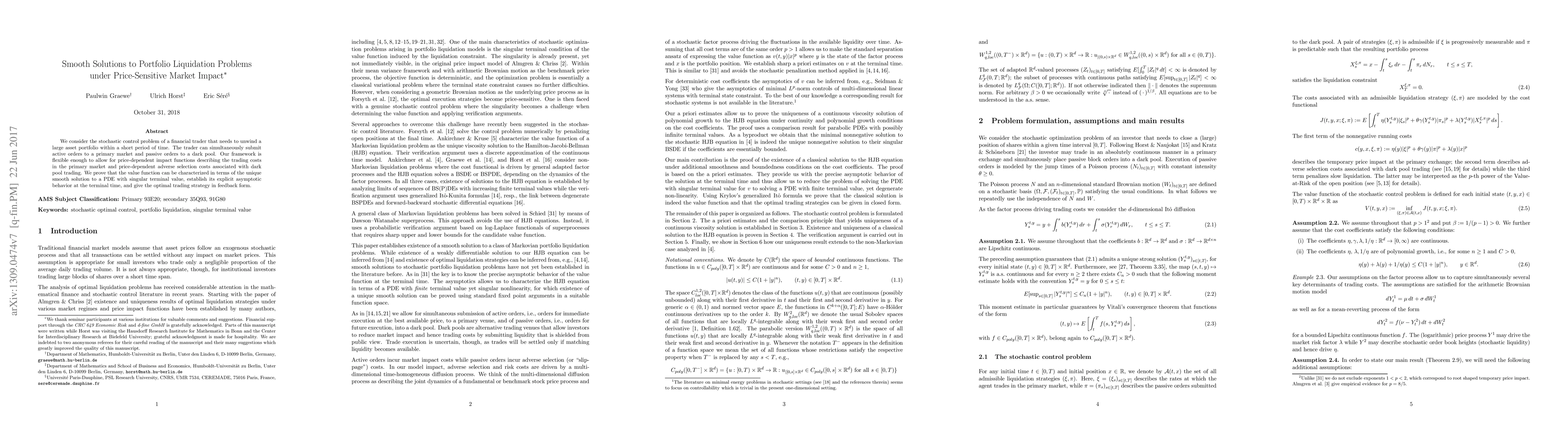

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)